This is the highest total ever recorded in the first half of any year, and 1.8% more than during the same time a year prior, although it is 7% below the high water mark set in the second half of 2020, according to the latest Renewable Energy Investment Tracker from research company BloombergNEF (BNEF).

The latest data on renewable energy investment in the first half of the year, drawn from BNEF’s database of deals and projects, show that a decline in investment in new renewables projects was offset by a jump in equity offerings of renewable energy companies.

New equity raised on public markets hit a record high at $28.2 billion in 1H 2021, as did venture capital and private equity commitments to renewable energy companies at $5.7 billion. These were major contributors to the strong overall first half. At the same time, investment in solar projects was up 9% year-on-year. Wind asset finance, however, fell year-on-year, as it stands in contrast to 1H 2020, which was a bumper period for financings of major offshore wind farms.

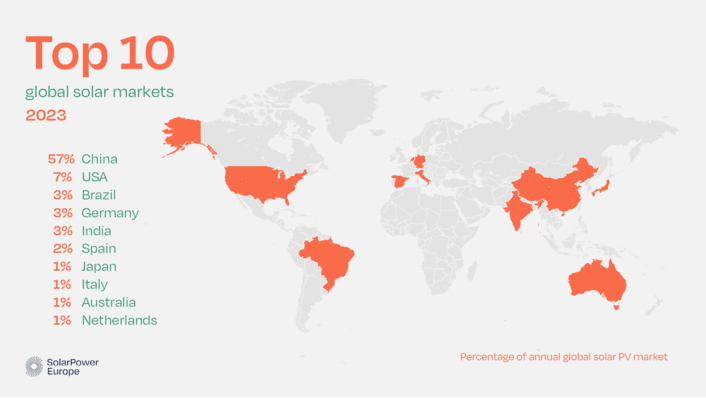

Record solar investments in China and the U.S.

Albert Cheung, head of analysis at BloombergNEF said: “Renewable energy investment has withstood the effects of the global pandemic, in contrast to other sectors of the energy economy where we have seen unprecedented volatility. However, a 1.8% year-on-year increase is nothing to write home about. An immediate acceleration in funding is needed if we are to get on track for global net zero.”

Also interesting: Solar power on track for terawatt scale by 2022

Investment in solar projects rose to a record $78.9 billion in the first half of 2021. Solar projects in China garnered $4.9 billion in 2Q 2021, up from $2.8 billion in the first quarter. The increase was largely driven by major financings of gigawatt-scale ‘subsidy-free’ projects developed by state-owned enterprises like China Energy Investment Corp. and Huanghe Hydropower, which must be commissioned this year. Large-scale solar project investment in the U.S. rose to $6.4 billion in 2Q 2021, from $5.3 billion in the first quarter, driven by a number of large projects closing. Solar project investment often accelerates in the second half of the year to meet end-of-year deadlines.

So-called ‘funds in circulation’, which includes the refinancing of renewable energy projects, mergers, acquisitions and buyouts, totalled $68.3 billion in 1H 2021, up almost 18% from a year earlier. The first half saw the highest ever total for equity raised on public markets by clean energy companies, outpacing the volumes raised in any previous year. A bull run for clean energy shares enabled many companies to issue new shares to finance growth – though valuations are now down from their highs at the start of the year.

BloombergNEF

Renewable energy and related companies raised a total of $28.2 billion on public markets in the first half, up 509% from last year. Among the largest share offerings, Chinese renewable energy generator China Three Gorges Renewables raised $3.5 billion, PV manufacturer Longi Green Energy Technology raised $2.4 billion, and U.S. fuel cell company Plug Power pulled in $2 billion.

Logan Goldie-Scot, head of clean power at BNEF, said: “As the energy transition accelerates, investors are increasingly looking for ways to increase their portfolio exposure to renewable energy and related areas, such as energy storage and hydrogen. This record first half for clean energy fundraising underlines the strength of appetite for sustainable investment opportunities aligned to a net zero future.”

India leading in merger and acquisition activity

Merger and acquisition activity is an important part of the renewable energy financing picture, although these deals are not included in BNEF’s overall new investment figures as they do not provide new money for technologies and developers. In 1H 2021, corporate M&A and private equity buyouts totaled $22.4 billion, up 25% on the previous year’s $17.9 billion. India outpaced the U.S. and China, which were the leading markets of 2020. (hcn)

Did you miss that? G-20 countries support fossil fuels untenable to achieve climate goals