The Albanian energy market has entered recently in a transformation that for many reasons were even difficult to be imagined only few times before. As far as here we are referring to those that are already concrete developments even still at the embryonic stage, we will focus on the binomial correlation from one side of the opening of the market as an essential obligation in comply to the international commitments, and on the other the possibility that this offer on the increase of the use of alternative technologies, especially photovoltaic, not only for businesses but also by each family in Albania.

High potential for photovoltaics and hydroelectric

The above cannot be different, consider electricity as a commodity distributed in the network, whose value is mainly related to the country and time at which it is available. In this sense, Albania has a significant potential of renewable energy, well distributed throughout its territory among the many hydroelectric and photovoltaic sources, far above the average of many others European countries. At the same time, depending on the continued support of traditional sources, the reference prices on the long-term markets of the region now have reached the lowest historical levels of 35-40 Euro/MWh. A low price that it is a subject of a strong fluctuations in the spot market, moving between much higher values such as those at 100-200 Euro/MWh.

To maximize the above, by putting into practice the EU's Third Energy Package since 2015, depending also on the mandatory nature of the natural monopoly of electricity networks, and on the other with free option to pursue of the most appropriate model in terms of implementing the framework for investment in achieving the EU's renewable targets within 2020, is becoming more and more pressing the need to advance with liberalization and opening up to the economies of scale offered from the regional energy market.

On the above, it is working in parallel with the advancement of the national energy exchange platform (APEX), that of the intraday balancing market, and the expansion of network capacity distribution through the joint western Balkan auction office (SEE CAO) in Podgorica. Further, by the end of 2018, the Albanian market is expected to be coupled with that of Kosovo, also passing on the adoption of the same mechanisms and protocols with the rest of the Balkans as well as beyond the Adriatic, and generally with the internal energy market of the EU.

Therefore, in the context of pan-European developments regarding electricity supply, the country is on the verge of beginning a free market that will be fully shaped by the dynamics of telematics exchanges (PXs). To enable this, the current market model and the accompanying rules determine the entry into the free market this year of large consumers that account for about 38% of consumption. In more, energy for losses about 26% of the total should be bought in the free market. Finally, for household customers accounting of the remain 36%, regulated tariffs should be maintained as long as a liquid market is created, reflecting all real costs in the final energy tariffs.

Significant investments from distribution operators

To accomplish the above, it is being followed by the gradual opening of the vectorization for alternative suppliers in the distribution network, the latter for mid-voltage voltages in 35 kV, and by March 2017 for the first time even at low level and 20 kV. As a result, the distribution operator plans to invest significantly, the amount expected to reach about 350million Euros in the next five years, with regard to administrative processes and especially technical automation to ensure the efficiency of the transition consumers from traditional to alternative energy supply.

The above should come to practice depend on attractive offers covering the additional costs compared to the traditional supplier (OSHEE). Thus, despite the current profit margin of between 10-20%, for companies that want to enter the supply segment, it allows commercial risk only in small and restricted parts of certain categories. Among other things, actual costs, currently calculated on average 6 lek/kWh for import energy, will become more clear and comparable only after the launch of the KESH energy exchange and transit through it to OSHEE. Moreover, it will take a long time for private companies to form the necessary expertise, but what is more important to be complemented with the interventions that will be necessary from the practices.

Opportunity for a green development

However, all above open up to the "gold" opportunity for a green development through new and more efficient economic model, more resource-oriented, proactive consumption, cutting down the emissions and the best protected of natural environment, etc. Specifically, to meet the requirements repeatedly expressed by the World Bank reports, in particular "Doing Business 2014", the recent interventions of the Ministry and the Energy Regulatory Authority have already opened the way for the network to receive energy input produced by businesses and households by generating distributed resources based on the net energy measurement scheme.

Thus, in parallel with the advancement of the system towards full market liberalization, the adoption of the structure of the transmission and distribution system is increasing also the opportunities for the use of alternative energies by consumers. In addition to attracting new customers to the free market, perhaps with the option of mid-term contracts at a fixed price for electricity which remains to be looked how attractive will be, the consumers at the same time have the opportunity if they are interested in accessing in a proactive way in generating energy for their needs.

Decentralized generation and consumption

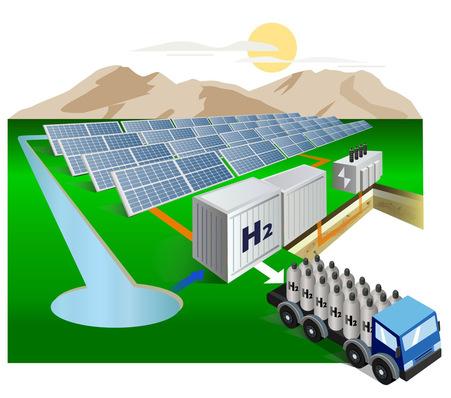

Thus, the final solution of the binomial "alternative supply vs self-supply" seems to now depend only on the speed of competitive offers penetration, where the first companies entering the market will be rewarded with slightly lower cost of the system. However, the distributed photovoltaic energy resources have the advantage of avoiding network problems as they are produced directly in the place where their consumption is needed. In addition, out of the total number of consumers one third is located in the capital and the rest in the largest urban and rural areas of the western lowland or in other areas with high solar radiation such as Elbasan, Korça, etc.

Certainly, to meet the above-mentioned challenges, commercial and technical issues regulations remain essential. A framework in which the energy authority (ERE) should play a key role in securing market competition! Regulatory activity that will still need to ensure that the network operator, currently public, does not restrict or condition consumers in any way or form of switching in terms of supply. In addition, it is essential that the distribution operator apply non-discriminatory and transparent rules and tariffs for all forms of distribution network usage.

Then, in summary, Albanian energy network operators have certainly to invest a lot and for a long period of time to build a super-fast power network. But the upper liberalization reform can be translated into a catalyst not only for maximizing benefits from the integration of the Albanian energy market to economies of scale but also for the development of smart energy networks and what is more important the efficiency growth of the use of alternative energy technologies especially from the PV generation by the business but also the family householders. (LG/HCN)

For more on above please find the related presentation kept by Dr Lorenc Gordani recently at the Western Balkans Second Regional Forum for Regional and Local Economic Development, Vlore, Albania.

Read more about energy storage

Stay informed, get our free newsletter twice a week. Register here.

More useful information:

http://www.pveurope.eu/News/Solar-Generator/Solar-powered-irrigation-in-Croatia-on-the-rise

https://www.pveurope.eu/solar-modules/growing-solar-market-bosnia-and-herzegovina