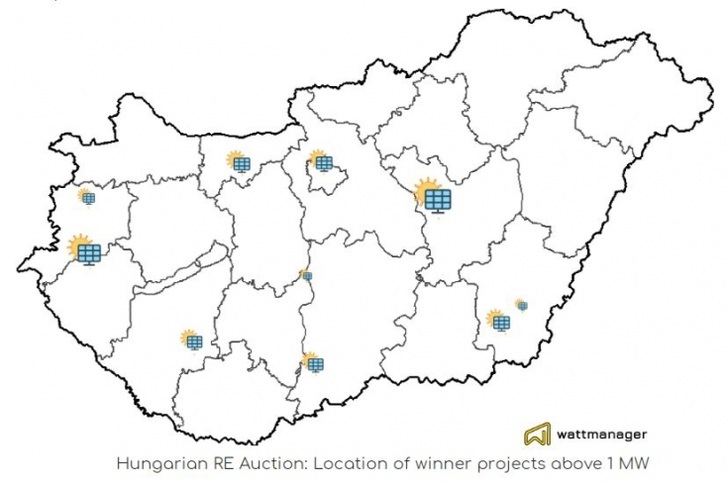

Clearly, developers have priced solar as the least-cost renewable technology in Hungary. The weighted average price in the small PVPP category was 75,57 EUR/MWh, while at the large PVPP 66,08 EUR/MWh and the total annual offered power is 193 GWh. The Hungarian Government sees solar as the pillar of its renewable energy policy, targeting 6 GW of PV by 2030. Existing PV capacity sits at around 1 GW excluding the additional 400MW rooftop system, which leaves a gap of 5 GW to deploy. It is likely that the auction-based approach will be the main (but not exclusive) mechanism to fill this gap and that means it will have to be worked hard up to 2030, with the potential for running more than one round per year.

Hungarian RE auction. Locations winner projects above 1 MW.

The Government’s broader policy commitment to sustainability and renewables are underpinned by a range of other interventions. The Climate and Nature Protection Plan released in February this year include enhanced subsidies for electric and hybrid vehicles and a goal of being 90% carbon-free by 2030 looking towards nuclear and solar as the main drivers.

Wattmanager, an independent renewable energy consultancy based in Budapest, recently released its report titled “Outcomes and Opportunities” which explores just those - a game commentary of the results and how the competition could be enhanced in future rounds. Their in-depth analysis sheds light on not just the improved transparency of the process and the prices offered, but also why many developers were disqualified, unable to clear the starting blocks. Christian Bayer, Commercial and Regulatory expert at Wattmanager, discusses other challenges that include FOREX risk with Euro-denominated capital costs to be paid for by HUF contracted prices, alongside tender documentation issued only in Hungarian.

Ferenc Kis, renewable energy expert at Wattmanager.

The latter poses a certain barrier to foreign entrants and could be reviewed in the future. There is clear evidence of foreign interest in the Hungarian solar PV market. The report was downloaded by developers, manufacturers, institutional investors, law firms and the “big four” in China, Russia, Turkey and throughout Western Europe wanting to gain an independent insight to the evolving dynamics of the Hungarian PV market.

Did you miss that? Electricity industry calls on policy makers for a green recovery

Ernst and Young released its Renewable Energy Country Attractiveness Index in May and interestingly, Hungary does not register among the top 40 countries. Renewable energy expert Ferenc Kis questions the absence of Hungary: “We are not a huge market, but 5 GW for solar PV alone is significant. Other elements of the methodology, including access to finance, strength of the regulatory framework, long-term contracts, grid stability and a range of local and international contractors on the Hungarian market demonstrate that Hungary does have the foundations in place for an attractive market.”

The next auction is likely to take place in H2 2020. “The competition is sure to be an exciting one”, Kis says. (HCN)