The revision is intended to ensure that Member States are treated equally. It would also give them more flexibility in applying reduced rates and zero rates, and would phase out preferential treatment for environmentally harmful goods. "We have reached agreement on the proposal for a Council Directive on VAT rates. This dossier has been discussed in the Council for a long time," said a pleased Andrej Šircelj, Slovenian Finance Minister. The Commission had already presented its proposal to amend the Council Directive on the common system of VAT on 18 January 2018.

See also: EU taxonomy sends wrong signals

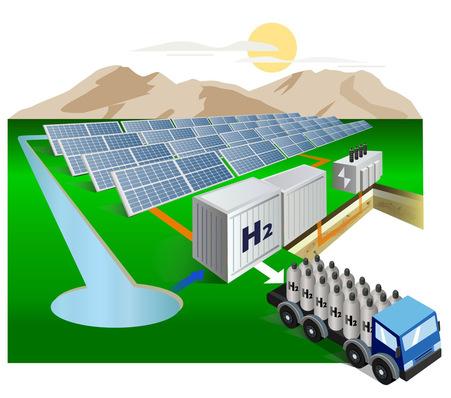

The Council has updated and modernised the list of goods and services for which reduced VAT rates are allowed (Annex III of the VAT Directive), taking into account the digital transformation of the economy. The updating of the list was based on a number of principles, such as benefit to the final consumer and general interest. However, in order to prevent a proliferation of reduced rates, the Council decided to limit the number of items to which reduced rates can be applied. However, solar panels are on this list.

Lower tax rates for solar panels and electric bicycles

The Council agreed to phase out reduced VAT rates or VAT exemptions for fossil fuels and other goods with a similar impact on greenhouse gas emissions by January 2030. Reduced rates and exemptions for chemical fertilisers and chemical pesticides will be phased out by January 2032 to give small producers more time to adapt. In addition, the Council has added environmentally friendly goods and services to the list of those for which reduced rates are allowed, such as solar panels, electric bicycles and waste recycling services. (mfo)