Menlo Electric has grown rapidly in global solar and storage distribution. Can you share more about the company’s history?

Menlo Electric was founded in late 2020, initially as a subsidiary of an installation company. From the very beginning, our goal was to build an international distribution business, operating across multiple markets. This strategy was designed to mitigate the impact of fluctuations in demand within any single market, ensuring long-term stability and growth.

Also interesting: European Energy puts its largest solar park in Poland into operation to date.

Did the strategy work?

It allowed us to expand rapidly, despite a market slowdown in Poland after net metering was phased out in Q1 2022. In 2021, we sold nearly 200 MW of solar components. The following year, our sales tripled to 600 MW, and in 2023, we reached 900 MW. Last year, we surpassed 1.3 GW of components sold. To put it in financial terms: in 2021, our revenue stood at €50 million, growing to €150 million in 2022. Over the past two years, despite the drop in component prices, our revenues have remained stable as we continued to grow in volumes.

What are Menlo's main markets?

We are primarily active in Europe, the Middle East, and Southern Africa, with an emerging presence in the United States.

How have you experienced the sharp decline in component prices in recent years?

Module prices did decline at an unprecedented pace, at times falling by 30% per month, as seen in mid-2023 and again towards the end of 2024. Battery and inverter prices also plummeted. According to Bloomberg, battery prices declined in 2023–2024 at the fastest rate since 2017. At the same time, the European residential solar market contracted significantly. According to data from SolarPower Europe, residential installations in Europe shrunk by 30% in volume. When factoring in the impact of falling component prices, the market declined by more than 50% in value.

Also interesting: R.Power Poland: Pure Energy for Posh Fashion

Can you share a concrete example of the impact of this slowdown?

For example, SolarEdge, a key manufacturer in the inverter and storage market, saw its quarterly sales drop from nearly $1 billion to approximately $200–250 million. As distributors and installers rushed to liquidate their stock in a shrinking market, intense competition drove selling prices significantly below purchase cost.

The market for commercial PV and solar parks has picked up in Europe. Couldn't that compensate for the lost share in the residential sector?

For modules, the impact was somewhat mitigated, as many of the same products can be used across both: residential and commercial & industrial (C&I) installations. However, the situation was far more severe for inverters and batteries, which are typically specifically designed for residential use and cannot be economically or technically repurposed for C&I applications.

Also interestin: RWE has scored big in the tender for PV systems in Poland.

Sounds like a journey in troubled waters.

Market contraction led to a huge oversupply, leaving many distributors struggling to unlock capital from their inventories, which in turn created cash flow challenges. As a result, several distributors faced serious financial difficulties.

Menlo Electric is active internationally. Did your strategy not allow you to compensate for problems in some markets with growth in others?

Interestingly, similar trends emerged simultaneously in different parts of the world, although for different reasons: In the United States changes to net metering regulations in California led to a sharp slowdown in the residential solar sector, putting U.S. distributors in a situation very similar to their European counterparts. In South Africa the residential solar market contracted significantly as ESKOM effectively addressed load shedding issues. By late 2023, power outages were already reduced, and by the first quarter of 2024, they were virtually eliminated. This removed a major driver for residential solar demand.

Also interesting: similar trends emerged simultaneously in different parts of the world, although for different reasons

What's the solution to this situation?

This intense crisis has actually driven increased cooperation between companies that previously operated purely as competitors. In the current market, distributors are buying and selling components among themselves across different regions, trying to rebalance supply and demand for various solar and storage products.

How have your suppliers, i.e. manufacturers, reacted to the crisis?

According to our experience manufacturer support has fluctuated. Particularly in the second half of 2024, when it became clear that the downturn was more prolonged than many had anticipated, several manufacturers scaled back or put on hold their support mechanisms for distributors. This has added further strain to an already difficult market.

Also interesting: Energix Polska teams up with Nomad Electric for 30 MW solar power project

Sounds like tough times and market consolidation

Overall, the industry is undergoing a significant reshuffle. Some distributors are reducing their international footprint, while others have gone out of business entirely. The coming months will likely bring further consolidation, as companies adapt to the new market realities.

How has the crisis hit Menlo Electric and how is it being dealt with?

It should come as no surprise that Menlo Electric has been significantly affected by the current crisis. As one of the youngest and fastest growing companies in this sector before the downturn, we did not have the time to accumulate substantial earnings that could serve as a financial cushion during such turbulent times. As a result, we have had to adjust our strategy, expanding our portfolio, focusing on key markets and increasing sourcing from other distributors across Europe. This approach allows us to remain agile while navigating the current market conditions.

Also interesting: EIB Group signs PLN 701M deal to fund Polish home PV installations.

So, what is your outlook for the future?

We remain optimistic about the future. Back in late 2020, Menlo was a company that could fit into a single room. In just three years, we scaled to €150 million in annual sales across four continents. I see absolutely no reason why we won’t rebound and return to our growth trajectory once the market stabilizes. Our priority now is to protect the foundation we have built over the past four years and position ourselves for renewed growth as soon as market conditions allow.

What key challenges did you face when expanding globally?

Running an international business in Poland, especially when expanding beyond the European Union, comes with unique hurdles. One of the challenges we experienced was finding a banking partner that could support our operations not only in Poland and Europe but also in key markets like the Middle East and South Africa. We quickly realized that there were only two banks with the necessary global footprint and presence in Poland. Fortunately, we were able to establish a strong partnership with one of them, HSBC Poland. It has provided us with tremendous support and flexibility over the years. The same applies to our partner KUKE, an insurance company belonging to Polish Development Fund Group. It has allowed us to extend insured credit limits to our clients not only across EU, but also e.g. in Ukraine and Southern Africa. With this kind of support, we will continue to build Menlo’s international presence.

Also interesting: Poland: Expert Energy Storage Conference in Warsaw.

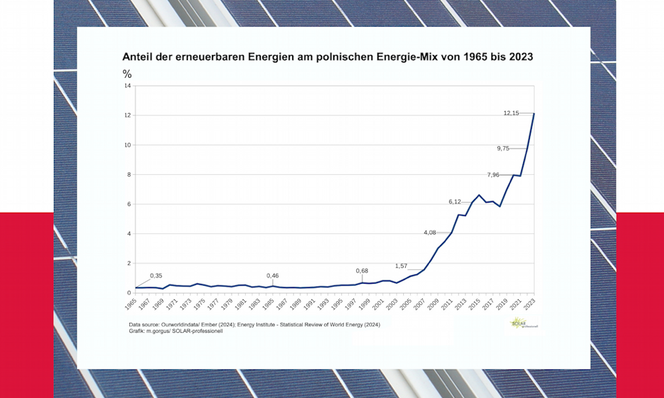

Even though Menlo is internationally oriented, how do you see the future of the Polish PV market?

PV sales will remain stable for large systems. In my opinion, we will see more and more installations of energy storage in the residential market soon. The Polish electricity grid is a problem that needs to be addressed. It was and still is in a bad state and its rapid improvement is necessary for a further and sustainable expansion of photovoltaics.

The interview was conducted by Manfred Gorgus