"Actually, things are going badly all over the world," says Gerard Scheper. "Only in the US, Australia and China things are still going quite well."

With consumer demand still very low, market recovery seems a long way off. A phenomenon that plays out worldwide with a few exceptions. "Very little is still happening in the private market and the pipeline for 2025 is still virtually empty for many companies," says Scheper.

Low margins – storage market a cycle path

"On top of that, the margins on the products sold are also low. When the market emerged, there were still gross margins of 25 percent with low sales. After sales went up, that margin dropped towards 15 percent. Now companies are on margins of 10 to 15 percent and nothing is being sold. Although the sale of home batteries can compensate somewhat, they are still not the volumes in which solar panels were sold until recently."

Also see: “A company cannot be on hold for a year”

The business market is a completely different story. "That works out quite well. The market is at about 80 percent of what it was until recently. Here, too, more and more projects with energy storage of up to 100 kilowatt hours are being built. Especially for farmers and SMEs, who already have solar panels on their roofs, an investment in battery storage is extremely lucrative. Until recently, the solar market was a really busy, big highway. The energy storage market is just a cycle path," says Scheper.

New players are entering the market

"Energy storage is much more complicated in terms of certification, bank guarantees, grid connection and software. Connecting the software to the grid is also more complicated because it can differ per country what this looks like. In the Netherlands, for example, this is very different from Belgium and Germany. On top of that, you don't always have to deal with the most flexible parties. That also makes it interesting, because it is not at all certain that the brands that are now big in the battery market will soon dominate the market. Whole new players are entering the market."

For the free WOS storage report, register here: https://theworldofsolar.com/free-market-outlook-report

The fact that the solar energy market is not moving fast is a global phenomenon. After energy prices have dropped back to their old level, the increased demand for solar panels does not appear to be permanent. "Only in the US, Australia and China things are still going quite well. In the US, solar panel producers can get three times more for their panels than in Europe. As a result, they still earn more in the US – despite the import tariffs – than in Europe," says Scheper.

Changes in the Chinese domestic market

"This is leading to Chinese solar panel manufacturers moving their European teams en masse to these areas. Chinese manufacturers who previously focused only on foreign markets are now also focusing on their own domestic market. Some of them have had a domestic office and a sales team for one or two years, they do have a chance. Or they enter into a partnership with another party that has been active there for a while."

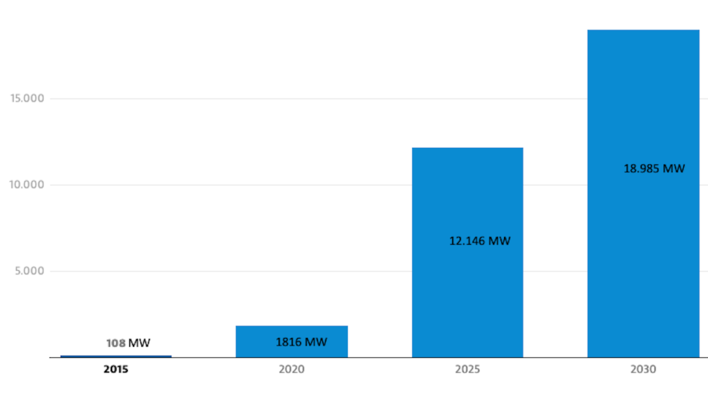

Also see: Central & Eastern Europe: Utility-scale storage market set to increase fivefold by 2030

But according to Scheper, something else is changing in the Chinese market. "Producers of polysilicon and wafers are taking matters into their own hands and are now also producing and selling solar panels. They have a stable overcapacity of 50 percent and think they can earn more if they also make the end product themselves. In this way, they do not have to scale down their production of polysilicon and wafers."

Reduced tax benefit on Chinese module exports

Finally, it is the top Tier 1 manufacturers who have put their stock on sale for some areas at even lower prices. "In this way, they want to create liquidity and then they just leave that area. Dutch companies in the solar energy sector will therefore have to ask for clarity from their Chinese suppliers: How important is Europe to you and what will that be like in the next quarter?"

Also see: General price decline continues amid steady demand in the European solar market

Last Friday it was announced that the Chinese government has intervened and reduced a tax benefit on the export of solar panels by 4%. This means that all panels shipped from China after 1-12 will become 4% more expensive. The rumors are that the Chinese government may also reverse the remaining 9% tax benefit and that could mean that the price will be driven up by 13% in a short time. (GS/hcn)