2023’s new solar installations would cover more than half of India’s annual electricity needs or more than Brazil’s entire consumption. Compared to Europe, the annual installations would exceed the total yearly electricity consumption of Sweden, Netherlands, Belgium, Finland, Czechia, Austria, Portugal, and Greece – combined.

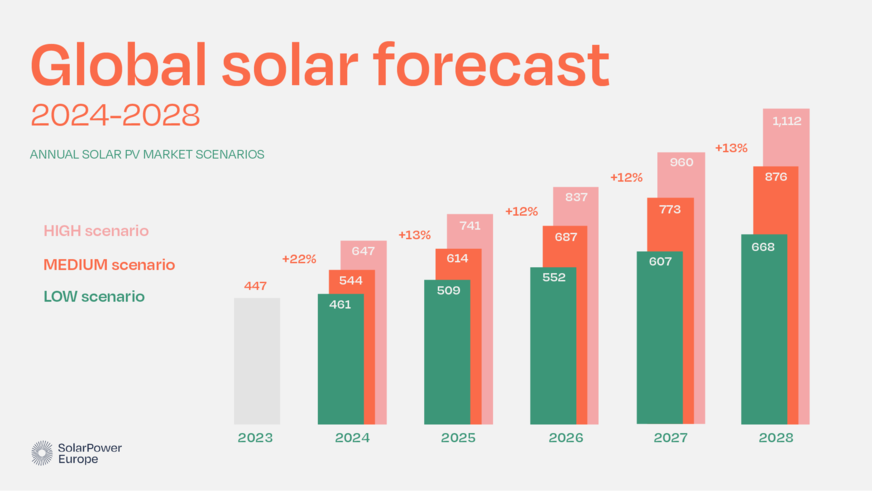

SolarPower Europe’s annual Global Market Outlook for Solar Power 2024-2028 reveals growth rates not seen in over a decade, since 2010 when the global solar market was only 4% of what it is today.

Solar continues to soar amongst its renewable colleagues, installing 78% of the total renewable energy installed around the world in 2023. This is reflected in the IEA World Energy Investment (WEI) 2024 report, which demonstrates that investment in solar PV in 2023 surpasses all other energy sources combined.

Growth expected to slow

Walburga Hemetsberger, CEO of SolarPower Europe said, “The world has truly entered its solar age. The sky is no longer the limit. How far solar can go will be determined by equitable global access to financing, and the political will to deliver flexible energy systems fit for the renewable reality.”

The top 10 markets represent 80% of global solar installations in 2023, with the leaderboard disproportionately drawn from advanced economies. While the number of advanced solar markets – installing at least 1 GW annually – grew in 2023 to reach 31 countries (up from 28 in 2022), the list does not heavily feature emerging economies. As per the WEI 2024 report, clean energy spending in emerging and developing economies only accounts for 15% of total clean energy investment worldwide. $ 12 trillion USD needs to be deployed to achieve the COP28 target of tripling renewables by 2030 – solar will deliver half of this target.

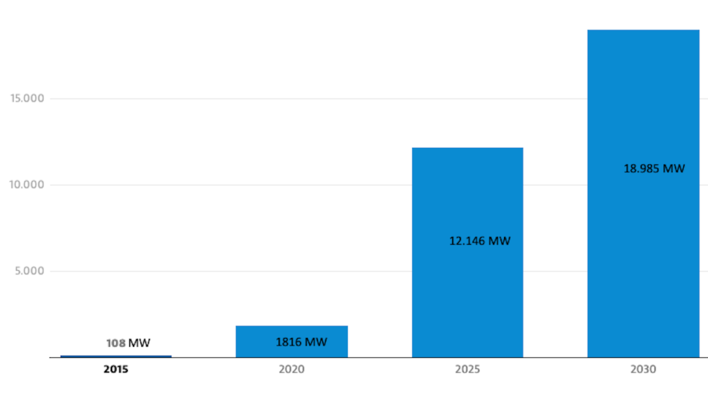

Looking to the future, the world is set to reach more than 2 TW of total solar capacity this year, having only reached the 1 TW level in 2022. However, between 2024 and 2028, year-on-year growth is expected to slow in the face of high interest rates, an energy crisis resolved – for now, and grids around the world struggling to keep up with renewable demand.

Solar Power Europe

Michael Schmela, Director of Market Intelligence at SolarPower Europe said, “It’s all just a little bit of history repeating – the world revises its solar estimates upwards and we get a glimpse at the vast potential of solar. By 2028, we could be installing more than 1 TW of solar a year. It’s now about setting targets in line with reality, and addressing the familiar challenges – permitting, regulations enabling profitable business models, and the new frontier – system flexibility, through vast amounts of battery storage capacities. The sector is ready to deliver the decarbonised energy system, and policymakers must wake up to the climate and energy security solution on their doorsteps.”

China dominating – „stay united as an industry“

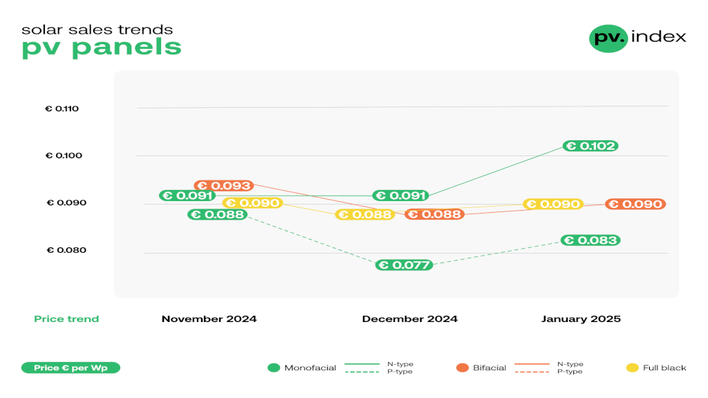

For now, it seems that China will determine the rate of global solar growth, though it continues to be one of the most dynamic, and difficult to predict, markets. In 2023 alone, China installed 57% of global capacity – 253 GW – equivalent to the levels installed globally in 2022. On the manufacturing side, a massive scale-up of capacity have led to solar panel price collapses of around 50% last year, and a growing consolidation of the solar manufacturing industry in the country.

Sonia Dunlop, CEO of the Global Solar Council said: “China continues to set the pace of the global solar transition. But to keep 1.5C alive, it is more important than ever that we stay united as an industry. No one country or company can achieve this goal on their own. We must work together to build new markets with untapped potential, create fair and resilient supply chains, and inject massive amounts finance for solar to lead the energy transition.”

Also see: Market turmoil continues – JinkoSolar taken off Tier 1 list

To better understand solar developments in China, this year’s report covers the country in a dedicated chapter, provided by the Global Solar Council and its member, the Chinese Renewable Energy Industries Association (CREIA).

See also: “The PV industry is navigating a complex competitive landscape”

Launched annually at Intersolar Europe in Munich, the Global Market Outlook for Solar Power is produced in partnership with the Global Solar Council. (hcn)