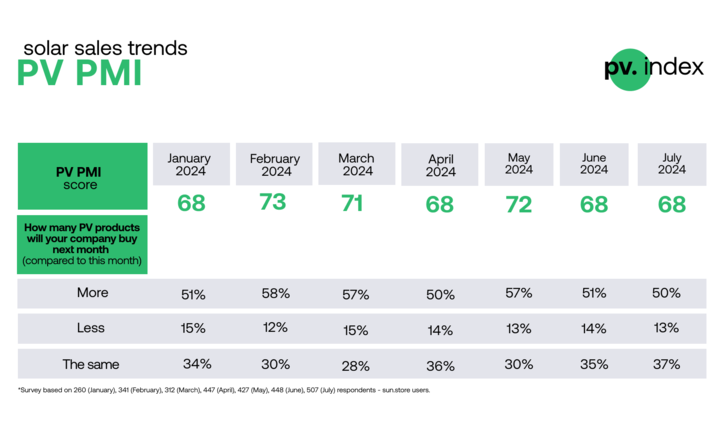

The PV PMI (PV Purchasing Managers' Index), which gauges the overall demand outlook in the industry, reflects input from sun.store buyers. sun.store is the largest solar marketplace in Europe, boasting more than 13,000 registered users and over 6 GW of equipment available from a multitude of brands.

The index, based on responses regarding future purchasing plans, remained steady at 68 in July. However, the breakdown of purchasing intentions shows strong market confidence. In July, 50% of respondents plan to increase their purchases, 37% intend to maintain their current purchase levels, and only 13% expect to decrease their orders. These results are very similar to those observed in June, indicating a consistent outlook among buyers.

See June`s pv.index and PV PMI

Generally, July's PV PMI score remains robust. With half of the respondents intending to boost their purchases in August, this solid PMI result suggests that demand will continue to be strong across Europe, despite the challenges faced by the industry and the vacation season. The decline in prices is primarily attributed to an oversupply in the market.

sun.store

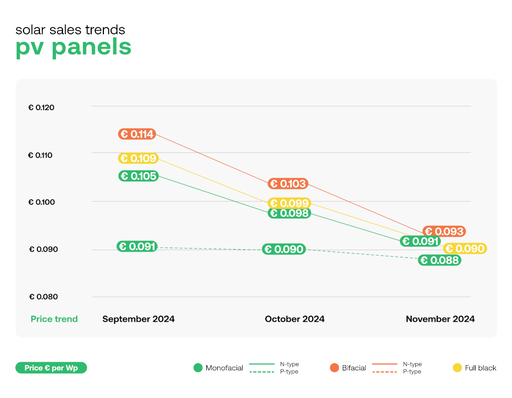

The pv.index tracks the average transactional prices on sun.store, derived from the activities of over 13,000 registered users across more than 40 European countries.

Continuing June's detailed breakdown, we provide insights for the monofacial category, including N-type and P-type modules, as well as N-type modules for the bifacial category.

Monofacial modules:

N-type: Average price fell by 13% from 0.128 EUR/Wp to 0.113 EUR/Wp;

P-type: Average price incresed by 11% from 0.103 EUR/Wp to 0.114 EUR/Wp. This increase was driven by a surge in demand for specific P-type models, which may be end-of-series or soon-to-be discontinued.

Bifacial modules:

N-type: Average price dropped by 11% from 0.136 EUR/Wp to 0.121 EUR/Wp;

P-type: too small sample to calculate the trend.

Full black modules:

The price dropped by 6% from 0.123 EUR/Wp to 0.116 EUR/Wp.

Jinko Solar remained the most preferred brand among buyers.

Ongoing overstock issues across Europe

Agata Krawiec-Rokita, CEO & Co-founder of sun.store, commented: „In July, we have witnessed a continuation of the trend where prices are declining, particularly in the N-type and full black modules. This is largely due to ongoing overstock issues across Europe and fierce competition among manufacturers to clear out inventories. The seasonal slowdown due to summer vacations has also contributed to a reduction in installation activities. #

Despite these factors, market sentiment remains positive, as evidenced by our stable PMI score. We are closely monitoring the situation and anticipate that the upcoming months, especially with expected regulatory changes in September, will bring new dynamics to the market. The resilience of the industry continues to be a key highlight, and we are optimistic about future developments.“

About – pv.index & The PV Purchasing Managers' Index (PV PMI)

pv.index traces current trading prices for solar components on a monthly basis. Data is recorded on sun.store, the biggest online PV trading platform with 6 GW+ of components on offer. Trading prices are weighted by the power of components involved in the transactions to arrive at a reliable estimate for the whole market.

The PV Purchasing Managers' Index (PV PMI) is a measure indicating the overall sentiment towards the demand in the PV industry. PV PMI shows whether demand is expected to expand (above 50), remain stable, or contract (below 50), as perceived by purchasing managers.

The PV PMI was calculated as: PMI = (P1 * 1) + (P2 * 0.5) + (P3 * 0), where: P1 = percentage of answers reporting an improvement, P2 = percentage of answers reporting no change, P3 = percentage of answers reporting a deterioration. Survey is based on a sample of 500+ sun.store buyers. (hcn)