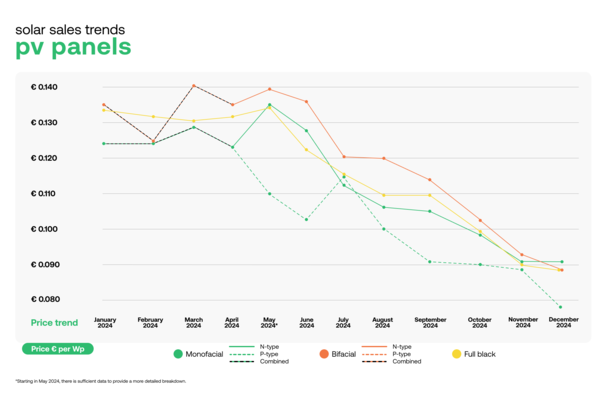

Prices for solar modules have remained largely stable over the past four weeks. Standard modules are still being traded at 13 cents per watt. As in the previous month, efficient modules with at least 22 per cent efficiency and modern cell technologies are also being sold for 21 cents per watt.

No increase in sight

However, they remain at an all-time low. Since the beginning of the year, prices have fallen by 7.1 to 8.7 per cent. "This month, module prices have no longer fallen across the board. But an increase or recovery to a level at which new products manufactured in Europe can be offered competitively seems unattainable in the long term," explains Martin Schachinger, Managing Director of the online marketplace for solar components PV Xchange.

Module manufacturers are giving up and moving away

Prices for project planners are still stable and, above all, low. However, the situation remains tight for European module manufacturers. This is because they cannot keep up with the competitive prices of their Asian rivals. "More and more manufacturers of solar modules are threatening to shut down their production due to the ongoing low price phase in Europe," warns Martin Schachinger. "Some want to give up, others want to move to the US, where market and subsidy conditions are supposedly better."

Still plenty of stock available

This is not entirely wrong, says Martin Schachinger. "The current module prices in Europe do not reflect a wholesome, industry-friendly market situation. On the contrary - the price level is still dominated by emergency and stock clearance sales on a large scale," he emphasises. Obviously, there is still a lot of stock available at second and third-tier retailers and manufacturers, or it seems to have built up again. Martin Schachinger puts this down to the cold snap of the past few weeks, which had Europe firmly in its grip. As a result, demand for solar systems has not yet returned to the level expected for this time of year, meaning that the module surplus is only flowing out slowly.

Old module technologies are becoming shelf warmers

In addition, there are a lot of lower-performance modules on the market. If these are equipped with modern cell technologies, they can still be sold reasonably well. However, standard modules with an output of around 400 watts are increasingly turning into slow sellers, which are often sold off with a vengeance - a lower price limit is not in sight, says Schachinger.

US discusses import tariffs

He also refers to the threat of import tariffs being reintroduced in the US for bifacial glass-glass modules. At least this is currently being discussed. "The reason for this is probably a petition submitted by Hanwha Q-Cells to the Department of Commerce in order not to jeopardise the planned expansion of production on the North American continent," explains the PV-Xchange boss. "If this petition is indeed successful, the prices of non-Chinese modules in the US would also rise sharply unless they are produced locally."

This would put further pressure on the European market and the already low module prices. This is because these modules, whose import into the US would be hindered as a result, would then probably end up in Europe.

Europe must act

Politicians in Europe must therefore come up with something as quickly as possible if they do not want to lose further domestic module production in the foreseeable future. However, the window of opportunity that has opened up is being missed. The FDP recently campaigned against resilience bonuses for systems built with European components. That is why the course must now be set in the right direction at European level as quickly as possible. "Currently, every day that no action is taken, a small part of our independence in the energy sector dies," warns Martin Schachinger. "And the amount of time and investment we need to make a fresh start is getting longer and longer," he says. (su/mfo)