What role does the Polish market play for IBC?

Patrik Danz: IBC Solar is active worldwide. Our focus is on the European market, although as a company based in Germany, the national market is particularly important to us. Poland is a very exciting market for us and is one of the top five in the European photovoltaic project business. We have therefore been active in Poland for many years. The first projects were managed from the headquarters in Franconia until we founded a branch in Warsaw in 2022 – IBC Solar Poland.

Subscribe to pv Europe newsletter now

How is your Polish company structured?

Our team in Warsaw currently consists of 10 colleagues, all of whom are experienced PV professionals and very familiar with the specifics of the Polish market. Seven of them are responsible for sales, the others for marketing, management and financial accounting. We started in Poland with a long-term perspective. Accordingly, we offer our employees secure jobs with sustainable growth prospects. In our view, the Polish energy market, which is still largely shaped by coal-fired power generation, offers long-term potential in both rooftop and ground-mounted projects, as well as in component distribution.

Central and Eastern Europe increasingly in the solar gigawatt class

What role do bureaucratic requirements play in Poland?

We don't see this as particularly dramatic. In the Polish market, commercial and industrial projects are often focused on implementing self-consumption systems. For open-space projects, it is usually about PPAs, meaning the direct purchase of solar power from a system by consumers. All of this is manageable. A greater challenge is the limited grid capacity in Poland.

Polish Development Bank signs financing agreement with R.Power

But this a problem all over the EU, isn’t it?

Other EU countries are often more problematic. For example, grid connection conditions for photovoltaic systems in the Netherlands are much more difficult to implement than in Poland. That said, grid capacity in Poland frequently leads to systems being restricted in their output. On the whole, however, approval processes in Poland are relatively quick. In some cases, it can still take up to three years for a system to be connected to the grid, but this is also the case in other EU countries.

Strategic partnership of Menlo Electric and Sungrow

Are there some specific challenges?

What unfortunately happens in Poland from time to time is that documents get lost in bureaucratic processes. Then they have to be submitted at great expense. You should therefore stay on top of things regularly throughout the entire project and check the status of the work.

More news and insigts about the Polish market

Is IBC Solar also active as a wholesaler in Poland?

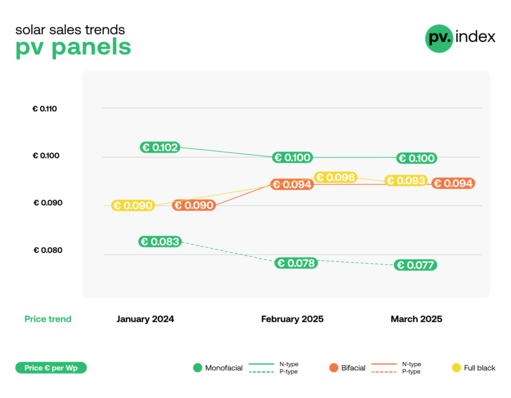

Wholesale is also an important mainstay for IBC Solar in Poland. The family home market in particular is interesting. The Polish wholesale business did well in 2022 that demand could not be met. In mid-2023, demand dropped noticeably and in 2024 sales fell sharply. But that is not a problem for IBC Solar because we know cyclical market fluctuations from our long experience. Competitors who filled their local warehouses during the solar boom are now struggling with the drop in demand.

Joachim Goldbeck: “Negative electricity prices are a bad fit with PPAs”

What role does politics play in the expansion of PV in Poland?

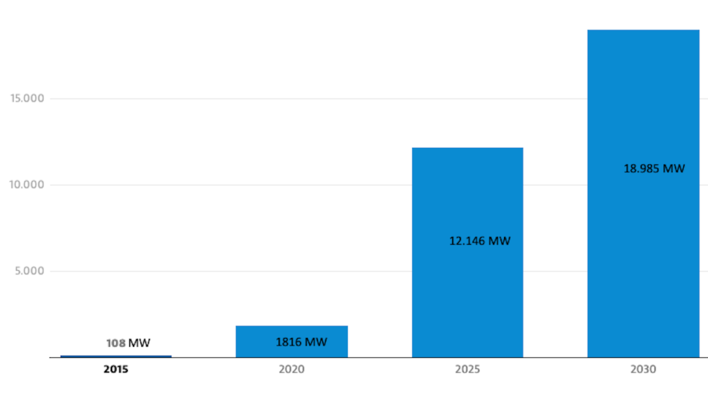

After the parliamentary elections in October 2023, the climate for renewable energies has improved noticeably. While the old government tried by all means to establish coal-fired power generation as the most important energy source in the long term, the expansion of photovoltaics has gained significant momentum under the new government. We expect annual growth of five to twelve percent by 2030. The new government is committed to expanding the electricity grid and is working on framework conditions that simplify and accelerate the expansion of photovoltaics.

Subscribe now to our monthly special newsletter for investors!

Your forecast for the next 24 months?

One thing is clear: growth. Not least because of the currently high share of coal-fired electricity in the Polish energy mix. Also because of the rising electricity prices and, last but not least, the rising prices for carbon dioxide emissions. The positive dynamics brought about by the new government will keep Poland in the Top Five European photovoltaic nations. We are therefore very optimistic about the Polish photovoltaic market.

Interview conducted by Manfred Gorgus.