Prices for solar modules continued to fall at the start of the year, although not as massively as last year. Standard modules currently cost an average of 15 cents per watt. This is one cent less than in December 2023. High-efficiency modules with an efficiency of more than 22 per cent and modern cell technologies are also being traded for one cent per watt less than in the previous month. They now only cost 23 cents per watt.

See also: Resilience of supply chains as Achilles' heel

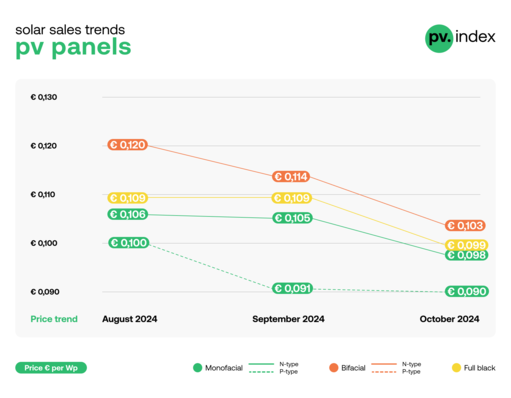

The low-price modules have exceeded the limit of ten cents per watt. These are modules with reduced performance, substandard products, insolvency products, used modules or modules with a limited warranty. This is because the Houthis in Yemen are firing on ships travelling through the Red Sea and the Suez Canal.

Freight costs are rising

This has prompted shipping companies to avoid the route and take the 6,000 kilometre longer route around Africa. This comes at a cost. Accordingly, the transport costs for a container en route from China to Rotterdam have already risen almost threefold, explains Martin Schachinger.

Demand currently restrained

Nevertheless, prices will only rise moderately. The PV-Xchange boss attributes this to the currently restrained demand in Europe. However, this is not uncommon at the beginning of the year. The cold temperatures mean that installers cannot get onto the icy roofs. The political situation is also playing its part.

Also interesting: Accelerating the journey to net zero

Solar customers are currently still waiting for Solar Package I, which has been announced by the German government for months but has been stuck in the decision-making process due to renegotiations on the federal budget. Accordingly, the budget law is currently on the agenda first. Solar Package I cannot yet be found there, but is expected to be passed at the end of February.

Customers are waiting for prices to fall

The main issue here is the urgently needed reduction in bureaucracy, which should ensure that more large solar installations - both on open spaces and on commercial and industrial roofs - are built. However, the rapid fall in module prices over the past year has also led customers and project planners to wait and speculate on further falling costs. This is putting further pressure on wholesalers, installation companies and project planners. "Many photovoltaic offers from last year are currently having to be adjusted downwards, as components have become cheaper and the competitive situation has intensified," says Martin Schachinger. "Even with small to medium-sized complete systems, not every overpriced installation offer has to be accepted uncritically and without price negotiation."

However, the wait-and-see attitude is not only having an impact on project realisation, but also on the demand for skilled workers. "There is hardly any talk of an assembly bottleneck at the moment, but the old problems could well resurface later in the year as soon as the market picks up again," explains Martin Schachinger. This is expected to happen once the solar package has been passed by the German parliament. (su/mfo)