After January’s signs of stabilization, February saw selective price adjustments. While some module categories — like monofacial N-type and P-type — experienced declines due to competitive pressures on popular brands, others, such as bifacial N-type and full black modules, recorded notable upticks. This divergence reflects a market balancing act between oversupply in certain segments and tightening availability in others.

Meanwhile, inverter prices continued to soften across both hybrid and on-grid categories, suggesting ongoing competition and stock normalization among suppliers. Despite these fluctuations, the strong PMI score indicates that buyers are undeterred, focusing on strategic procurement and premium technologies to meet rising demand.

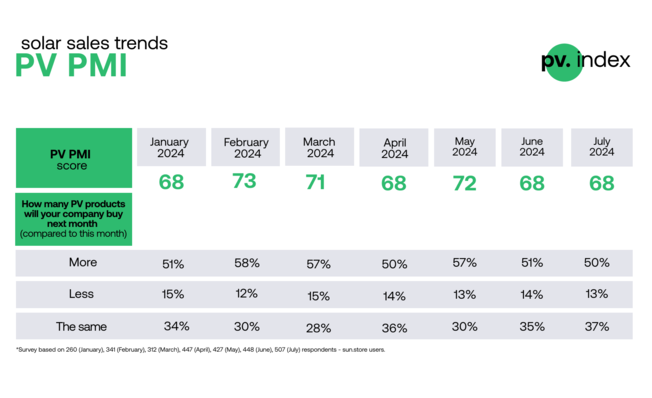

The PV Purchasing Managers' Index (PMI) remains an essential measure for assessing market sentiment and demand trends in the European solar industry. This index, derived from the purchasing intentions of over 600 users, selected from a pool of more than 24,000 registered on sun.store, offers a detailed snapshot of the market’s current condition and future direction. By gathering insights from a diverse group of installers, distributors, and other industry players, the PV PMI highlights shifting purchasing patterns, helping to track key developments in solar procurement across Europe.

sun.store

PV PMI: Buyer confidence peaks at 73

February’s PV PMI reached 73, the highest level in recent months, underscoring a bullish outlook among solar industry stakeholders. Based on responses from 630 buyers out of over 24,000 registered users on the sun.store platform, the survey revealed:

● 58% of respondents plan to increase purchases, reflecting proactive stockpiling ahead of spring projects.

● 30% intend to maintain current order volumes, ensuring steady market activity.

● 12% anticipate a reduction in orders, a consistent minority reflecting lingering caution.

This PMI score, calculated as PMI = (P1 * 1) + (P2 * 0.5) + (P3 * 0) — where P1 is the percentage reporting improvement, P2 no change, and P3 deterioration — highlights a market poised for expansion. Key drivers include:

Stabilizing supply and selective price drops

While some module prices dipped (e.g., monofacial N-type and P-type), reflecting competitive pricing from brands like JA Solar and AIKO, others rose due to tightening stock levels. This mixed trend has encouraged buyers to secure inventory early, anticipating potential supply constraints later in the year.

Preparation for peak season

With spring installation season approaching, the high PMI score suggests buyers are locking in orders now to avoid delays or price hikes. The focus on premium technologies, such as bifacial and full black modules, further supports this strategic shift.

Robust market sentiment

The PMI jump from 71 in January to 73 in February signals growing trust in market stability. Buyers appear less focused on chasing the lowest prices and more on securing reliable supply chains and high-performance components.

Expert commentary: The market in transition

Filip Kierzkowski, Head of Partnerships and Trading at sun.store, commented: “February’s data shows the market finding its rhythm. The PMI of 73 reflects confidence that goes beyond short-term price movements. Buyers are prioritizing availability, especially on premium models, as they prepare for a busy Q2. The slight dip in some module prices hasn’t slowed activity—it’s actually spurred strategic buying. This heightened interest in modules may also stem from news of legislative changes in China, where recent pricing reforms for grid-connected renewable power are redirecting production to meet local demand. As a result, this shift could significantly impact delivery schedules to the EU in the coming months.”

Bartosz Majewski of Menlo Electric: “We are navigating through a turbulent market”

Michał Kabała, Business Consultant added: “Limited availability of affordable, mainstream products has shifted buyer preference toward higher-quality, premium options offering better value. For example, Aiko modules saw a 16% price drop from January to February 2025, while Jinko prices rose by 3%.”

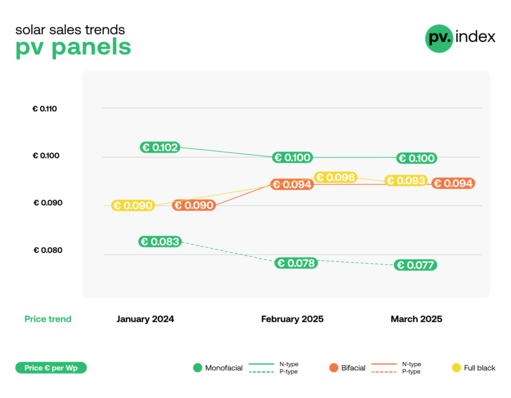

Module prices: a tale of two trends

February’s module pricing revealed a split narrative, with declines in monofacial categories and gains in bifacial and full black segments:

Monofacial modules:

N-type: Prices fell to €0.100/Wp (-2%), driven by competitive pricing on popular models from JA Solar and AIKO. Despite the drop, demand remained strong, supported by the shift toward high-efficiency options.

P-type: Prices declined to €0.078/Wp (-6%), reflecting softening demand for standard modules as buyers pivot to premium alternatives and stock levels normalize.

Bifacial modules:

N-type: Prices rose to €0.094/Wp (+4%), signaling robust demand for bifacial technology in large-scale projects. Tightening availability contributed to the uptick.

P-type: Insufficient sample size to establish trends.

Full black modules:

Prices increased to €0.096/Wp (+7%), driven by limited stock and strong demand for aesthetic, high-value installations. Sellers capitalized on this trend, pushing prices upward. This mixed performance suggests a market transitioning from blanket price declines to a more nuanced balance, with premium technologies gaining traction.

sun.store

Inverter pricing: softening across the board

Inverter prices continued their downward trajectory in February, reflecting competitive pressures and ample supply:

Hybrid inverters:

<15kW: prices eased to €121.27/kW, marking a decline of 2% from January. This subtle drop was fueled by steady demand in the residential sector, where homeowners and small installers remain active, yet suppliers ramped up competition to capture this consistent market share. The result? A slight price adjustment downward as brands vie for dominance in this popular category.

>15kW: larger hybrid inverters saw prices slip to €88.55/kW, a modest decrease of 1%. This gentle softening hints at a cooling in orders for bigger hybrid systems, possibly as buyers shift focus toward on-grid solutions or pause to reassess needs ahead of peak installation months. Even so, the change is small, suggesting this segment remains stable but not immune to broader competitive pressures.

sun.store

On-grid inverters:

<15kW: smaller systems saw prices fall to €55.64/kW, a reduction of 2% from the previous month. This decline reflects a market flush with stable stock levels, where manufacturers and distributors are feeling the heat of ongoing price pressure. With supply readily available, buyers in this segment—often tied to residential and small commercial projects—benefit from suppliers’ efforts to stay competitive.

>15kW: larger on-grid inverters experienced a slightly steeper drop, landing at €24.95/kW after a 3% decrease. This more pronounced shift points to a competitive push among suppliers catering to utility-scale and commercial installations. As these players jostle for position in a segment with steady but price-sensitive demand, the lower prices suggest an effort to clear inventory or attract bulk orders as Q1 progresses.

Brand preferences: LONGI, Sungrow and Huawei lead

February’s transaction data highlighted shifting brand preferences:

Modules: LONGI emerged as the top choice, overtaking Jinko Solar, thanks to its competitive pricing and reliability in both monofacial and bifacial categories.

Inverters:<15kW: Sungrow took the lead, reinforcing its dominance in residential and small commercial systems.

>15kW: Huawei surged ahead, favored for its performance in larger installations.

These preferences underscore buyers’ focus on trusted brands delivering value and efficiency amid evolving market conditions.

Outlook for the coming months

With a PMI of 73 and demand for premium modules on the rise, the European solar market is entering spring with momentum. While selective price drops persist, the increases in bifacial and full black categories — coupled with tightening stock — suggest a shift toward a more balanced supply-demand dynamic.The next few months will test whether this confidence translates into sustained growth, but February’s data paints an optimistic picture. Buyers are acting decisively, and the market appears well-positioned for an active 2025.

Expert analysis: Is the market optimism justified?

About – pv.index & The PV Purchasing Managers' Index (PV PMI)

pv.index tracks monthly trading prices for solar components, based on data from sun.store, Europe’s largest online PV trading platform with over 8.9 GW of components available. Prices are weighted by transaction power to provide a reliable market estimate.The PV PMI gauges demand sentiment in the PV industry, with scores above 50 indicating expansion. It’s calculated from a sample of 630+ sun.store buyers, offering a snapshot of purchasing intentions across Europe.The PV PMI was calculated as: PMI = (P1 * 1) + (P2 * 0.5) + (P3 * 0), where: P1 = percentage of answers reporting an improvement, P2 = percentage of answers reporting no change, P3 = percentage of answers reporting a deterioration. Survey is based on a sample of 900+ sun.store buyers. (hcn)