European solar production is urgently needed in order to manage the expansion of photovoltaics in Europe as planned. Above all, Europe must not be left behind now, as Christoph Podewils, company spokesman for Meyer Burger, emphasised. Three central things are necessary for this. In addition to investment support, there must also be support for operating costs. After all, module production is energy-intensive. Podewils assumes a support amount of between 230 million and 2.4 billion euros per year here. "Compared to what Europe still spent on oil and gas from Russia in 2022, this is a drop in the ocean," Podewils appeases.

See also: EU: Industry alliance to expand production of solar components

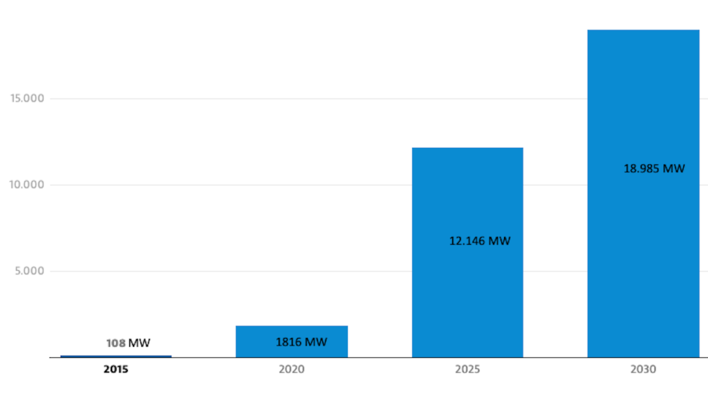

In addition, politics must also improve the framework conditions. After all, the manufacturers in Europe still have to pay customs duties for the preliminary products. If these are abolished and investment and operating subsidies come at the same time, Europe could raise the share of module production to 45%. Currently it is 86%, as Andreas Bett, head of Fraunhofer ISE, points out. "This 45% would mean building 30 gigawatt-scale module factories in the EU," says Podewils.

Responding to subsidies in other countries

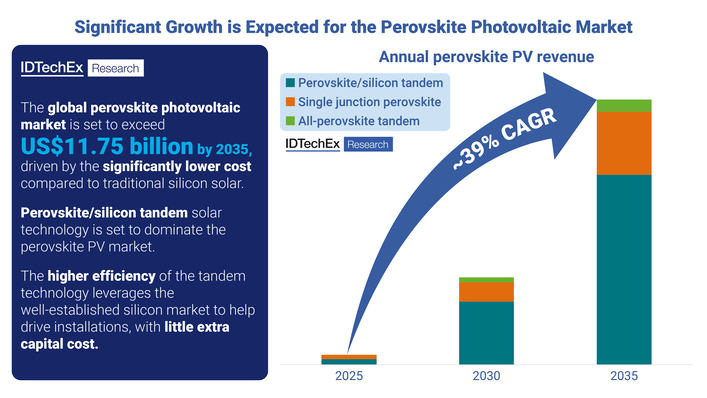

But we are not just talking about modules here, but also pre-products such as cells and actually wafers. And ingots. Here the EU is even more dependent on China. Because 99 per cent of the wafers and ingots are produced there and 91 per cent of the cells, knows Andreas Bett from Fraunhofer ISE. The expertise is available in Europe. But it needs support, he urges in view of the current subsidies in other countries. "In China there are subsidies, in Europe there are currently almost none. In the USA there are very high subsidies, just like in India - in addition there are tough customs measures in the USA and India to protect their own manufacturers," Bett gives an overview of the competitors for investments in solar production. Europe has taken a step in the right direction with various initiatives. Bett mentions, among others, the Green Deal Industrial Plan EU and the associations' initiative to build up 30 gigawatts of productoin in Europe by 2030.

Pricing in the CO2 footprint

In addition to investment support, he also advocates operating cost support in order to create such a green lead market for transformation technologies in Europe. In addition, however, risk assessment and research funding would also be necessary. Moreover, something can also be done on the customer side. "Because if we produce the cells in the EU, they will have a smaller carbon footprint," Bett explains. But this requires that a corresponding CO2 cost be consistently priced into the other cells and modules. "Building up the photovoltaic industry seems possible. But it is still a difficult road to travel. We have the political support now and we will see announcements on capacity building in the next six months," Bett is certain.

Europe is more flexible

It doesn't have to be the hurdles that have always stood in the way of European production so far. Because price will no longer play the exclusive role in the future. Markus Jandl, product manager at glass manufacturer Lisec Austria, makes this clear using modular glass as an example. "Until 2018, the focus was always on efficiency. That is why there were four standard module sizes produced by all manufacturers. In the meantime, the energy yield is more important and therefore the number of module sizes has increased," explains Jandl. "This means that glass production must always be adapted and made more flexible. That is the opportunity for European machine builders.

Also interesting: BSW Solar calls for more support in building European production capacities

In addition to mass production, there is also building-integrated photovoltaics (BIPV), which can be a possible mainstay for European producers. "BIPV will not be supplied from China. Here, production in Europe is necessary," says Jandl, referring to the higher requirements for certification and the necessary production flexibility." This also offers an opportunity for mass production in the EU. (su/mfo)