The past solar year made module traders sweat. The uncertainties in the global supply chains caused by Covid-19 and the restrictions in their own operations made things difficult for the dealers. But the challenges were overcome. "Module demand increased steadily over 2021, notwithstanding the accelerated price increase in Q3 and Q4," analyses Kai Lippert from EWS in Handewitt. "Even though the supply situation was tense at times, we were able to deliver 60 per cent more module capacity to our customers last year than in the previous year."

EWS: 60 per cent growth in one year

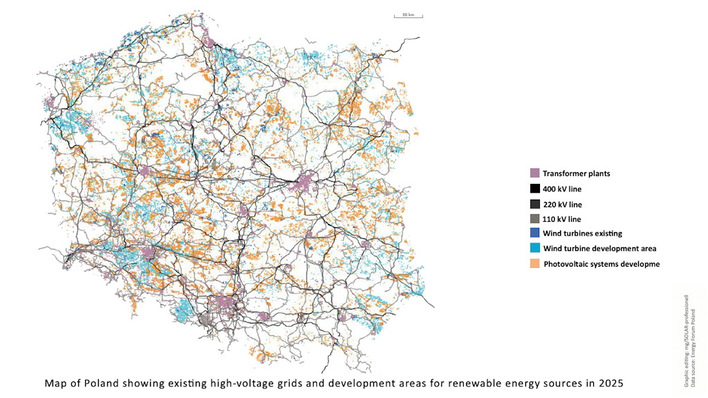

60 per cent growth within one year: the energy transition is picking up speed. The markets in Europe demand high-performance modules. "In mainstream modules, strong brands based on M6, M10 and G12 wafers were in demand," Lippert assesses. "The trend towards residential modules with full black optics and bifacial glass-glass designs has continued to strengthen." Particularly exciting for him was the growth in Sweden, Poland and the Netherlands, in addition to the strong German market.

Stay up to date, sign up for our newsletter!

2022 got off to a stormy start for EWS: "Fortunately, it's a tailwind!" says Lippert. "There is generally high demand in the residential and small commercial segments, but PPA plants outside the EEG also keep many of our customers busy."

Rising energy costs spur demand

Rising energy costs are fuelling the desire for self-sufficiency and sector coupling. Looking at Ukraine, Kai Lippert says: "Not least because of recent international tensions, interest in greater energy independence continues to grow rapidly." He hopes: "The Easter and summer packages announced by Robert Habeck could secure this revival from the second half of the year with resilient economic framework conditions."

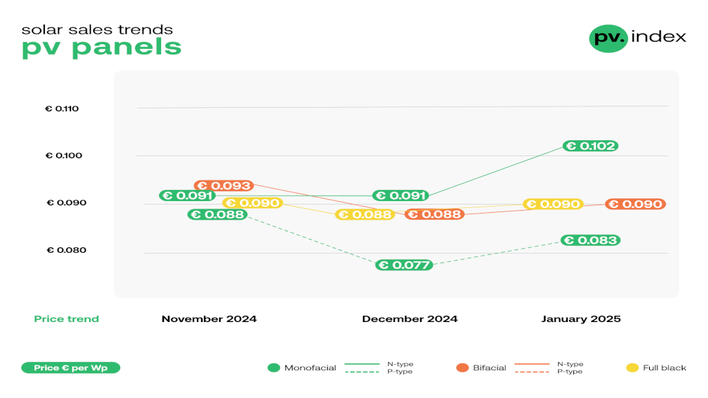

See also: Kai Lippert’s vision: Bold steps and enthusiasm

Kai Lippert has been active in the solar business for more than three decades and has been through many ups and downs. Prices, he estimates, are likely to remain high in 2022, but stable. Because: "Raw material prices for the preliminary products as well as transport costs will certainly remain at a high level in the medium term," he says. "An import-friendly euro to US dollar exchange rate is not in sight. We nevertheless expect stable module prices for the first half of 2022, but do not yet see any clear signals for the second half of the year."

Growing with customers

A preview of the third or fourth quarter of 2022 is currently like looking into a crystal ball. But: "If you are basically flexible, you don't actually have to wait long for high-quality solar modules," the trader holds out the prospect. "For us as a system provider, the availability of sought-after inverter and storage solutions is currently not in balance with the module supply. This is hitting the residential sector particularly hard right now." In addition, the capacities of the installing trade are currently exhausted, and the lack of skilled workers is making itself felt here. At least for modules: "As our customer numbers grow, we will be able to increase our delivery volume for the sought-after module series. I am very confident about that." (HS/mfo)

Also interesting: Yes to 45% renewable target by 2030