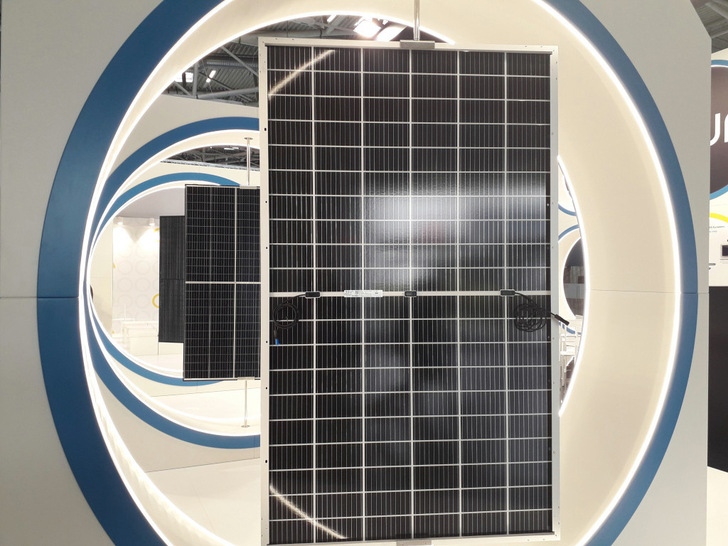

The prices of new Topcon double-glass modules with an efficiency of 22 percent and above in particular were revised downwards significantly in May and June. They are getting closer to the mainstream, so they are not giving manufacturers any breathing space. Competition is brutal, as faster market growth cannot be expected in the short term.

Growing too fast

The reason: the major Chinese suppliers have expanded their plants to 500 gigawatts in the past two years. Last year, the domestic market in China only took around 280 gigawatts. This year it could be 340 gigawatts. Because the Americans have reacted to the price dumping with punitive tariffs, only Europe remains as a sales market.

Solar modules are therefore offered in Europe for less than twelve euro cents. The cost of production in China is 13 to 14 cents. The costs for transportation by sea, customs and storage in Rotterdam as well as distribution by truck within Europe must be deducted from this.

Chinese banks are exercising caution

In contrast to the first crisis twelve years ago, Beijing will not be opening its coffers this time to bail out manufacturers with loans. In 2011 and 2012, an estimated 20 billion US dollars flowed to module manufacturers who were facing bankruptcy after the collapse of the feed-in tariff in Germany. At that time, the Chinese domestic market did not buy enough goods to make up for the shortfall in exports.

Also see: China wants to curb expansion of production capacity

It was reported in Munich that Chinese banks had been instructed to stop extending bad loans. The economy in China is in a tailspin. Nerves are on edge in Beijing. The bankruptcy of the Evergrande real estate group has triggered a national crisis, as millions of Chinese have been cheated and are now without housing.

No price turnaround with new cells

Back to the module business: hopes that more powerful modules with new cell technologies would turn the tide have not yet been fulfilled. Only a few solar modules with back-contact or tandem technology have seen an upward trend. Apparently, production of N-type Topcon cells and such modules has now been ramped up in China.

Dealers and installers still have large stocks of modules produced in 2023 or earlier. If these modules have the usual area of two square meters for roof systems in Germany, they are selling increasingly poorly due to their low output.

Building owners usually want the highest possible output and the latest technology in new systems. This makes it difficult to reduce stocks - and is a challenge for wholesalers.

Old stocks are being sold off

The stock of old modules, which was purchased at significantly higher prices, must be further devalued. However, not all players are able to do this, resulting in very different prices for modules with Perc cells on the market. Overall, the price difference between the categories is therefore shrinking.

Only those module manufacturers who can set themselves apart from the flood of mass-produced goods have a chance. And: it is far from certain that sheer size will actually ensure economic success - survival in the brutal module market.

Also interesting: Demand steady as prices continue to decline

Even if the situation is chaotic at the moment, there are likely to be some advantages for European manufacturers - at least in the long term: Lower transportation costs and associated emissions, proximity to customers, comprehensive service for installation partners. (hs/hcn)

German version here