Solar power is all the rage. Global photovoltaic installations rose by 58 per cent to 413 gigawatts (GW) in 2023, in Europe by 40 per cent to 56 GW. In Germany, PV systems with a capacity of 14.1 GW were newly installed, almost double the previous year's figure.

The solar value chain is dominated by China. More than 90 per cent of polysilicon, wafers, solar cells and modules come from the Middle Kingdom or from Asian countries whose factories are predominantly in the hands of Chinese owners. "Currently, less than two per cent of the demand for photovoltaics in Europe can be met by European production," states Walburga Hemetsberger, head of the industry association SolarPower Europe.

Price war due to overcapacity

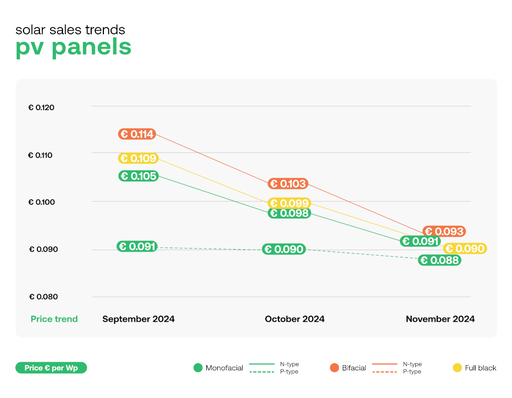

The situation for European manufacturers is exacerbated by the overcapacity that has built up, particularly in China. According to estimates, around 600 GW of modules can be produced in Chinese factories each year, which is a good third more than global demand. As a result of the oversupply, prices have fallen by more than 50 per cent in recent months. Inexpensive Chinese modules flooded the European market with competitive prices, some of which are significantly below production costs.

This was intensified by the rapid switch by many Chinese manufacturers from the previously predominant mono PERC PV modules to more powerful N-type modules, according to Dutch solar analyst Gerard Scheper. The stocks of modules with the older technology have often been sold off.

Calls for help and insolvencies

Calls for help from the European solar industry have been piling up since last summer. "If nothing happens now, there is a great risk that European solar producers will face massive problems in the coming months, some will even go bankrupt," warned 40 European solar companies in an open letter to Brussels in mid-September 2023. The ingot manufacturer Norwegian Crystals filed for insolvency back in August. At the beginning of September, the Norwegian wafer manufacturer Norsun temporarily suspended production. REC Solar Norway, the second most important European manufacturer of solar silicon (after Wacker Chemie/D), ceased production in November 2023.

The EU heads of state and government have repeatedly pledged to strengthen the domestic PV industry. Such a strong dependence on China in such an important industry of the future is too dangerous. The EU Commission also presented a Net Zero Industry Act as part of the Green Industrial Plan. The aim is to promote key green technologies in Europe. Among other things, resilient and sustainable generation systems - from European production - are to receive higher remuneration in auctions and tenders for solar power. The aim is to incentivise end customers to use PV modules and components "made in Europe".

Resilience bonus still has to wait

The German Solar Industry Association (BSW-Solar) has long been calling on the German government to introduce temporary resilience bonuses and additional resilience tenders as part of Solar Package 1. The payment is intended to compensate for the price difference between solar products manufactured in Europe and those from the Far East. However, this has not yet been implemented. In mid-November 2023, the Federal Constitutional Court overturned the budget of the traffic light coalition, which provided for aid for the solar industry. Since then, the FDP in particular has opposed the introduction of a resilience bonus.

Meyer Burger modules – no longer "made in Freiberg"?

The SOS calls escalated further. In mid-January 2024, Meyer Burger threatened to close Germany's largest solar module production facility (650 megawatts) in Freiberg, Saxony/Germany, in April if politicians did not take measures to create "fair competitive conditions" such as resilience bonuses. The company also had supply contracts with Norsun and Norwegian Crystals.

A few days ago, Gunter Erfurt, CEO of Meyer Burger, followed up and announced that he would no longer be manufacturing modules in Freiberg from March and would close the site with 500 employees at the end of April - unless politicians take countermeasures in the short term. Instead, the company wants to relocate production to the USA, where lavish subsidies beckon. In Goodyear (Arizona), the first PV modules are set to roll off the production line as early as May. In Colorado Springs, an old semiconductor factory belonging to chip manufacturer Intel is to be converted for modern solar cell production. However, the existing production of heterojunction solar cells in Thalheim (Saxony-Anhalt) is to continue for another year in order to support the ramp-up of module production in the USA.

Solarwatt and Heckert Solar also sound the alarm

Following Meyer Burger, the Dresden-based company Solarwatt has now also threatened to move its module production away. "If there are no prompt decisions from Brussels and Berlin, for example on the resilience bonus, we will be forced to possibly relocate production from Dresden to other existing production sites abroad," said CEO Detlef Neuhaus.

The Chemnitz-based module manufacturer Heckert Solar also sounded the alarm, cutting back its production and pausing investments in manufacturing. "But if there are positive signals, we will invest again," company boss Benjamin Trinkerl told Handelsblatt.

Resistance within the solar sector

However, there is also resistance to the required bonus from within the industry itself. Start-ups such as Enpal and 1Komma5 Grad, which sell solar systems and profit when PV modules are as cheap as possible, are opposed to this. The resilience bonus is a continuation of complex national special subsidies at the expense of the general public, wrote Philipp Schröder, CEO of 1Komma5 Grad, on LinkedIn.

Instead, Schröder responded with a surprising offer. The company was prepared to take over Meyer Burger's module production in Freiberg if the company gave it up. Enpal also announced that it would set up its own production in Germany and Europe. A Europe-wide consortium for the domestic production of solar modules is planned, according to founder and CEO Mario Kohle. In this context, he spoke in favour of direct investment and operating cost subsidies, following the example of Northvolt in Heide or Intel in Madgeburg.

Sporty EU target

It remains to be seen how realistic the newcomers' factory plans are. In the meantime, the German government has announced that it will adopt Solar Package 1 at the end of March at the earliest. The Net Zero Industry Act is also due to be finalised by the European Parliament and the EU Council of Ministers in the course of March. Whether there will be a resilience bonus or further support measures remains to be seen, despite the political tailwind from EU Energy Commissioner Kadri Simson and national initiatives such as those recently in Spain and the Netherlands. In any case, it is obvious that it will be pretty challenging to achieve the EU target of producing 40 per cent of European demand for solar modules in Europe by 2030.

Hans-Christoph Neidlein