Total corporate funding (including venture capital funding, public market, and debt financing) into the solar sector in Q1 2018 fell 65 percent quarter-over-quarter (QoQ) to $2 billion from the $5.7 billion raised in Q4 2017. Year-over-year (YoY), Q1 2018 funding was 38 percent lower than the $3.2 billion raised in Q1 2017, according to Mercom Capital Group.

“After a strong fourth quarter in 2017, financial activity slowed again in Q1 2018 to the post-tariff announcement levels of last year as uncertainties and a lack of clarity in the markets took a toll on investments,” commented Raj Prabhu, CEO of Mercom Capital Group. “The bright spot during Q1 was a record-high number of solar project acquisitions, proving that solar power generation is a sought-after asset class.”

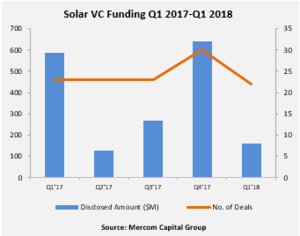

Global VC funding (venture capital, private equity, and corporate venture capital) for the solar sector fell 75 percent QoQ to $161 million in 22 deals compared to the $639 million raised in 30 deals in Q4 2017. The amount raised was also lower YoY compared to the $588 million raised in 23 deals in Q1 2017. The majority of the VC funding raised in Q1 2018 went to solar downstream companies with $124.5 million in 18 deals.

The top VC deals in descending order included: $55 million raised by Off Grid Electric, $25 million raised by d.light design, $23 million secured by Solaria Corporation, $12.5 million raised by Renewable Properties, $11 million raised by Kiran Energy Solar, and M-KOPA’s $10 million deal. A total of 30 VC investors participated in solar funding in Q1 2018.

Steep decline in public market financing

Solar public market financing came to $103 million in four deals in Q1 2018, a steep decline QoQ from the $657 million raised in 10 deals in Q4 2017. It was also significantly lower YoY than Q1 2017 when $461 million was raised in 13 deals. Sky Energy had the only solar IPO in Q1 2018.

Announced debt financing totaled $1.8 billion in 17 deals during the first quarter of 2018. In a QoQ comparison, 23 deals were announced in Q4 2017 for a total of $4.4 billion. YoY, $2.2 billion was raised in 25 deals in Q1 2017. Most of the debt raised in Q1 2018 was by solar downstream companies.

Large-scale project funding announced in Q1 2018 totaled $2.7 billion in 58 deals, down from $3.7 billion in 49 deals announced in Q4 2017. In a YoY comparison, $2.6 billion was raised in 33 deals in Q1 2017.

Just one residential and commercial solar fund was announced in Q1 2018 (for $400 million), compared to $213 million raised in three funds in Q4 2017. During the same quarter of last year (Q1 2017), $630 million was raised in six funds.There were 19 solar M&A transactions announced in Q1 2018 compared to 13 transactions in Q4 2017 and 29 transactions in Q1 2017. Of the 19 total transactions in Q1 2018, 10 involved solar downstream companies.

80 large scale project aquisitions

There were 80 large-scale solar project acquisitions (16 disclosed for $1.9 billion) in Q1 2018 compared to 67 transactions (26 disclosed for $3.7 billion) in Q4 2017. In a YoY comparison, 49 transactions (18 disclosed for $1.9 billion) were announced Q1 2017. About 7.7 GW of large-scale solar projects were acquired in Q1 2018 compared to 5.8 GW acquired in Q4 2017. There were 20 investment firms and funds that acquired 24 projects in Q1 2018, totaling 1.2 GW, followed by utilities and IPPs where 13 companies picked up 30 projects totaling 1.3 GW. Twelve Project developers acquired 14 projects for 3.4 GW during the quarter. (HCN)

Stay informed, get our free newsletter twice a week. Register here

More useful information:

http://www.pveurope.eu/News/Markets-Money/IHS-Markit-forecasts-solar-record-growth-in-2018