Globally, around 1.2 billion people do not have access to electricity. Cost erosion in solar, wind, and energy storage technology is creating new opportunities for the electrification of rural areas. On the solution side, two main segments can be distinguished: solar home systems and mini-grids / microgrids. Solar home systems are self-sufficient solutions for individual households. A small solar system is typically coupled with a battery to provide power for DC appliances day and night. Mini-grids may provide DC power or more sophisticated AC power through a semi-centralized system at the village level. Intermittent renewable energy from solar, wind or hydro solutions might be balanced by integrating energy storage, biomass or diesel generators. Pay-as-you-go (PAYG) solutions allow for innovative business models with mobile payment options.

In the last few years, the appetite for investing in these segments has been growing from impact and commercial investors.

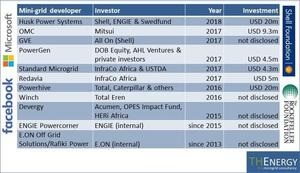

At the same time, utilities like E.ON and ENGIE have built up mini-grid capabilities from scratch. Technology firms such as Facebook and Microsoft support mini-grid development: they have set up the Microgrid Investment Accelerator – a USD 50 million support vehicle. Finally, foundations like the Shell Foundation and the Rockefeller Foundation foster mini-grid improvement. These activities have triggered interest from many new investors. Sometimes, a gap between the status quo and expectations is apparent. Typically, investors realize this within rather costly due diligence processes. Rural electrification companies must also take significant efforts to collect and present relevant information that is tailor-made for the needs of investors. In addition, they are required to disclose a significant amount of information during the process.

Streamlined approach for due diligence could cut costs

THEnergy has been consulting investors in rural electrification-related due diligence processes lately and has developed a streamlined approach that will significantly cut costs on both sides. “The objective is to make the process for future due diligences more efficient and to reduce transaction costs,” explains Thomas Hillig, Managing Director of THEnergy. The new methodology is based on the experience that, typically, a few factors are critical during the acquisition process. “Before the main process starts, we also provide detailed market information to investors which helps to manage their expectations and to select investment targets that correspond to their needs”, continues Hillig. The new approach will make funding for mini-grid players more cost-effective and will contribute to quicker growth. It can also be applied similarly to evaluate and optimize existing investments in mini-grid players. (HCN)

Stay informed, get our free newsletter twice a week. Register here.

More useful information:

http://www.pveurope.eu/News/Energy-Storage/Mini-grids-to-become-a-huge-energy-storage-market

https://www.pveurope.eu/solar-storage/tesvolt-supplies-rwanda-268-mwh-grid-solar-battery-system