How has the year 2017 gone for Luxor Solar?

2017 has been one of the most successful years in the history of our company, both nationally and internationally. For Germany we saw growth rates of about 145 percent, with the greatest increases in the segment of installations between 300 and 750 kilowatts. Growth overseas was not quite so large, but still considerable. And for the international panels business we are talking about a lot more markets.

What factors have acted in favour of this success?

Luxor Solar is still operated by the owners and has been in the market since 2004. Through careful management we have never been in financial trouble. We have a reputation as a solid and reliable company, and never ever let down a customer. That has been highly beneficial.

Has the pressure on the panel market been that high?

After last year’s Intersolar, many panel manufacturers chose to provide their products to the US, India or Turkey, while the European markets got the wrong end of the stick. On top of that, there was the insolvency of Solarworld. Both of these created a strong surge in demand, particularly for large-scale projects.

Large-scale require a certain amount of planning in advance…

Indeed, many large customers were suddenly left high and dry by their suppliers. We on the other hand have installing companies both large and small as our customers. These can always rely on us. When they were disappointed by their regular suppliers, we were able to make our move.

Were you fully able to deliver?

Yes, we were. Occasionally there may have been delays of two or three weeks, but because we keep in touch with our customers, we were able to harmonise these with their scheduling at the building site. Generally speaking, we were able to fulfil our delivery dates, and our customers value that very highly. For us, being partners is not just something we say, but something we actively engage in together with our customers. And that is valuable for both sides.

How many megawatts have you sold in 2017?

We do not talk about numbers, you will have to forgive me. That much I can say: Our factories have an annual production capacity of 500 megawatts. In 2017, we could have sold 50 megawatts more than that in Germany alone, if we had had the delivery capacity.

How are you selling your solar panels?

In practically all markets we go through two sales channels. Run-of-the-mill distribution for Germany is taken care of by our trusty wholesale partners Krannich Solar and EWS. Large customers can also place their orders directly with us. For Germany, that is about 30 companies that churn out volumes between one and about 30 megawatts per year. The largest majority of that is large installing companies and project developers, in addition to investors. For some of these, we are the sole panel supplier. For others, we are among the three most desired brands.

How is your turnover for Germany distributed among your customers?

EWS and Krannich together constitute about 50 percent of our volume in Germany; both firmly stand behind the Luxor brand and do a great job. We realise the other 50 percent directly. Based on the number of projects in the pipelines of our large customers, we expect a large proportion of our volume to be handled directly in 2018.

Which international markets are particularly interesting for Luxor?

We have been focussing on internationalisation since quite early on and are now active in more than 60 markets. In the most high-potential markets, such as Japan and the US, we have established branch offices. In Japan, we have been present, with a local team, since 2012 and have recently won the bid for a 15.5 megawatt project. From these branch offices we also serve the neighbouring markets.

How important are smaller markets?

The MENA region, where AE Photonics in Morocco is a key distribution partner, is also very important to us. In northern Europe, Sweden is our strongest market. In southern Europe, Greece and Cyprus are strong drivers. In eastern Europe there are new markets such as Albania, Bosnia, Macedonia, Montenegro and Serbia. We have been active in the Balkans for quite a while and that has given us great access to these markets. The same is true for Hungary. Poland and the Czech Republic are promising, but they are only developing slowly. The way I see it, they seem to go for isolation rather than opening up.

And in western Europe?

First and foremost the Low Countries, followed by Austria and Switzerland. Also, former markets are taking a turn for the better, specifically France and Spain. All of these markets are served via two sales channels: We take care of the project-based business directly, while distribution is handled through our wholesalers.

Which distributors are active in what regions?

Krannich Solar affords us a solid position in Belgium, specifically in Flanders, as well as France, the Netherlands, Austria, Switzerland and Spain. For the Low Countries, Ecostal from Jalhay in Wallonia is another capable distributor for Luxor that is able to speak to our French-speaking customers. Because of their geographic location, EWS is well-positioned to access the Scandinavian markets, chiefly Sweden, along with northern Germany and the Netherlands.

What are the peculiarities of these markets?

Quality counts for a lot. But also aesthetics. In the Low Countries, for example, customers prefer highly sophisticated dual-glass panels or full-black panels in the high-performance segment over 300 watts. These markets are less price conscious than elsewhere. People are willing to spend more for products that look good and last long. These are often buildingintegrated PV solutions. Similarly in Scandinavia.

Is Luxor Solar also active in the US?

Yes, we are currently supplying a project in Alaska. We are expecting that the US will remain an interesting market for the foreseeable future. Following a massive overproduction of solar panels last year, we have about 12 gigawatts in our warehouses. Using all of this up might take a while. In the US we are represented by Krannich Solar. Let us see how long it will take for US demand to pick up again.

How has the start of 2018 been for you?

With a very comfortable backlog of orders, which was great. Then the long winter that was not really a winter had reduced demand. In northern Germany there was still snow on the ground as late as April, so it took a little for the installing companies to be able to use up the stock they had in their warehouses.

So what did that actually mean for the first quarter of 2018?

In January and February we had a great – at least for that time of year – influx of orders, but the weather conditions resulted in delayed deliveries. In March, demand fairly went through the roof. The first quarter of 2018 was about 30 percent above our projections. The second quarter is also going better than planned; our order books are nice and full. The same can be said of the third quarter: We have sufficient orders until the end of September.

The markets for panels continue to pick up speed, so the outlook is more than promising. What potential hazards are you currently seeing?

I see two bottlenecks: On the one hand, there is not enough capacity for installation to get the panels up onto roofs fast enough. And there is a shortage of AC connection specialists, whom installing companies are in desperate need of – particularly for larger projects and medium-voltage AC connection.

That would affect the installation in Germany. Might 2018 once again see shortages in the market for panels?

For 2018, our people in Asia and the well-known analysts are forecasting capacity additions of 55 to 60 percent for China alone. The highest increases are expected for the fourth quarter, which means that panel manufacturers will have to deliver in the third quarter. There is a risk of shortages in vital materials for panel production.

Can you be more precise?

We are already noticing a slight rise in the price for silicon and polycrystalline wafers. So far, this does not affect monocrystalline wafers, and availability for the European market is still sufficient. But even as the second quarter progresses, this might change.

We already saw that in 2017, when many installing companies were hoping for a fall in panel prices around the time of the Intersolar…

And the exact opposite happened. The key is long-term planning to avoid that installing companies will have to go hunting for solar panels in the third quarter of 2018. Our partner have already let us know what they will need in the third quarter and have made down payments to ensure they will get it.

How are technologies for the panels developing?

We want to further increase the output. And we will. After all, with panel prices falling, shipping costs become more significant. The price of metals – aluminium in particular – are also rising. That puts pressure on the manufacturers of mounting systems. So it is important to get as much out of the panels as possible.

What innovations will you be presenting at the Intersolar in Munich?

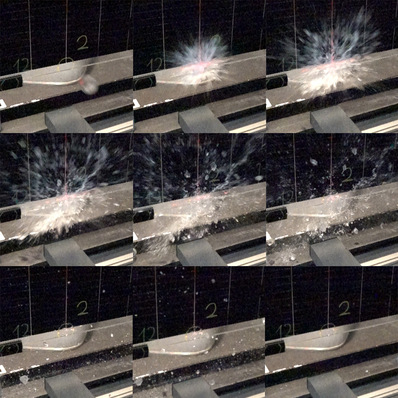

Our Eco Line product range encompasses grid-connected standard panels made up of poly- or monocrystalline cells. This year, we will show our new half-cut cell panels that provide higher output. We are also continuing to work on a multi-bus bar technology. Furthermore, minimum-glare panels and BIPV are gaining in significance. At our booth (A1.190), we will present a number of interesting solutions in that area.

Luxor Solar also provides smart panels. What does the future hold for this class of products?

Smart panels are one of our mainstays. We have been offering them since 2013. Then we started out with electronics provided by Tigo. We are currently even integrating Solaredge’s DC optimiser into the connection sockets. This has proved critical in markets where emergency cut-off is mandatory. In such cases, there is hardly any alternative to Tigo or Solaredge. MPP tracking down to the level of individual panels further allows an improved fitting of even quite tricky roofs, particularly for commercial buildings with various potentially shading elements. That also contributes to increasing the performance of the solar generator.

How does the performance go up?

You can nudge closer to the edge of the shading element, and thereby get more panels on to and more output out of the same area. And using smart panels, reduces the need for DC wiring. Separate optimisers increase the electrical resistance of the overall system. Integrating the electronics into the connector socket makes the system more efficient, and thus also increases overall performance. (HS)

Stay informed, get our newsletter twice a week.

Register here: http://www.pveurope.eu/Newsletter

Join our Guided Tours at The smarter E and EES Europe 2018 in Munich!

http://www.pveurope.eu/News/Solar-Generator/The-smarter-E-Europe-2018-Guided-Tours-for-Professionals-pv-Guided-Tours

Read more on solar modules in Europe:

http://www.pveurope.eu/News/Solar-Generator/Smart-solar-modules-offer-enhanced-durability-easier-installation-and-lower-LCOE-Andrea-Viaro-of-Jinko-Solar-Europe-says

https://www.pveurope.eu/solar-modules/solar-modules-costs-prices-and-finance-at-a-glance

https://www.pveurope.eu/solar-modules/solar-modules-our-insight-stories-at-a-glance

http://www.pveurope.eu/Products/Solar-Generator/Solar-modules/IBC-Solar-puts-out-the-new-Monosol-Module-VL4-with-300-Watts

Read more about solar modules.