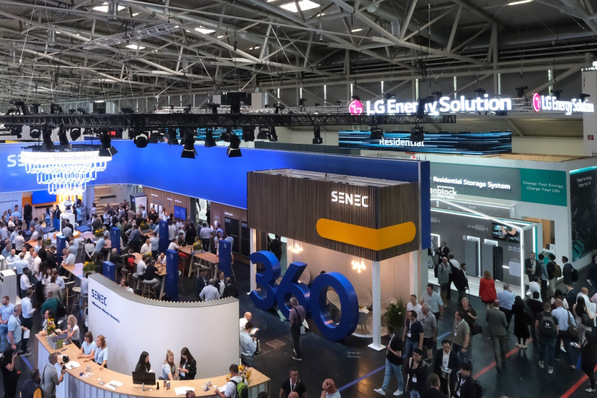

Last summer Europe was gripped by football mania, but Asians were not invited to play. Not at the tournament in France, that is, but certainly at the Intersolar in Munich, which happened at the same time as Euro2016.

Walking around the exhibition halls made me think of my childhood hero: The Korean football player Bum-kun Cha, who in the 80s first played for Eintracht Frankfurt and later for Bayer Leverkusen. His prowess as a striker and his infamous 30-metre hammer blows earned him the nickname Cha-Bum. Can you remember?

The time for restraint is over

Cha-boom is also what happened at the Intersolar: Because Korean energy storage supplier LG Chem presented Resu, their new line of storage units. It marks the end of any restraint the Koreans have shown until now. They rolled out a storage unit that will invigorate the sector on a global scale. Cha-boom! And this time the Koreans will do everything they cannot get side-lined.

And because they combined high energy density with easy installation, the new Resu storage units were awarded the EES Award. They come in capacities of between 3.3 and 9.8 kilowatt hours (in the low-voltage variant with 48 volts: LV) and between seven and 9.8 kilowatt hours (high voltage, 400 volts: HV). The battery modules are conveniently housed in cases that can easily be carried and installed by one technician.

The new super-cell JH3

At the heart of the new storage units is the excellent cell JH3, which marks quite a leap forward in lithium technology by LG. This cell was developed as a traction battery for electric cars and has 63 ampere hours. In a way, it is too large for domestic storage; using the more common lithium cells of 40 ampere hours would allow the building of smaller storage units.

But what matters most to LG is cost: High-performance batteries such as these will in the future also be used for domestic storage. Because they have both high energy as well as power density, they are equally useful for both markets. The emerging market for car batteries is actually expected to out-perform the market for stationary storage by several orders of magnitude. We are not there yet, but it will happen soon – 2018 at the latest.

A well-conceived product range

LG did not present a distinct product but rather a well-conceived range of products that fits a numbers of applications in the private segment. Because the Resu units can operate at low as well as high voltages, they can be combined with nearly all common inverters. That is in line with the distribution strategy that this globally active company operates by for all their products: Go through wholesalers, who then combine them into packages – or do not. The units can be installed indoors or outdoors. Software updates happen via SD card.

What is noteworthy is that the low-voltage Resu are compatible with SMA’s Sunny Island, the inverters by Sungrow (China) and Omro (Japan). The high-voltage batteries run with the new Sunny Boy Storage (SMA), with the SnapINverters by Fronius and with the power electronics of SolarEdge – to name but a few.

Focussing on global business

This indicates that the Koreans are paying attention to distribution on a global scale. Europe – and Germany in particular – is just the first bridgehead, or a proving ground for new products. The success of Munich even impressed the bosses in Korea. The Korean team was immediately given a day off, which given the Korean attitude to work clearly means something.

The question is what impact this will have on the storage market. Until now, Far Eastern companies such as LG Chem, Panasonic (Sanyo), Sony and Samsung have mostly acted as suppliers of the lithium cells. Samsung have had difficulties in domestic storage, while their large-scale batteries also were not doing too well because the units themselves used too much electricity. Samsung did not come to Munich this year. Meanwhile Sony has sold its battery business to Japanese supplier Murata.

Actually low-cost cells

Just like LG, Panasonic presented their own storage units, albeit not in a product range of comparable breadth and at different DC voltages. LG Chem were able to go that way because the new JH3 cell is very energy-dense and is adaptable to all kinds of applications – in both the segment of stationary and the mobile storage.

Cells that come rolling out of fully automated factories by the million – the only way for lithium batteries to actually become cheap; and the only way they can follow the example of micro chips, mobile phones and flat screens – or solar cells and panels for that matter. From an economic standpoint it absolutely makes no sense anymore to build cells specifically for domestic storage. This is LG’s message: Here comes mass production, here comes the mass market.

In Munich there were still a number of suppliers of storage units that used the older JH2 cells in their batteries. These are recognisable because their current collectors are both on the same side and they have the familiar geometry – similar in proportion to a sheet of paper. The JH3 cell is much narrower and more elongated, and its current collectors are on different sides. That is why the Resu storage units are so handy and slim.

Tesla learned their lesson

The question now is whether in the future there will even be any storage suppliers that will be allowed to use LG’s latest generation of cells. Because that essentially was the message from Seoul: We have this new super-cell – and we’re using it to make our own storage units! This should generate greater competition among storage manufacturers who do not produce their own lithium cells.

This even affects well-known providers of storage such as Tesla. The battery modules of the first generation of the Powerwall consisted of small round cells by Panasonic, like the ones that Tesla also uses as traction batteries in their cars, with up to 96 kilowatt hours of capacity. These cells are designed to last 500 to 600 charging cycles, which seems perfectly sufficient for EVs. When used in the Powerwall, these cells are dead within three years, since a stationary storage unit usually goes through 200 cycles in a year.

Now the Powerwall has within it Samsung’s small round cells, which promise a longer service life. And since Samsung does not have storage units of their own on the market, there is no competition, like there would be if they used LG cells. The sector is currently at a crossroads that other sectors have already gone beyond: How deep should the vertical integration of a global company be in order to make the most of all technological advantages?

Fronius makes it easy for installing companies

SolarEdge has been a distributer for the Powerwall since the beginning of this year, while Fronius will start in late September, at first only to German-speaking markets and Australia. It will be available everywhere else in November. The reason for the delay: Originally, Fronius was planning to develop an inverter specifically for the Powerwall, but they now have come up with a neat way of hooking it up to the Symo Hybrid that already controls their Solar Energy Package.

That makes life easier for the technician, as he can use the same equipment for both batteries. Adapting it is done by software. The Solar Energy Package is a three-phase system for which Fronius gives a 15-year warranty on capacity – considerably better than the previous fair value warranty.

Fronius use cells by Sanyo. The high-voltage battery holds between 4.5 and 12 kilowatt hours and about 1,650 of them were sold last year. Fronius has decades of experience in batteries, for example for autonomous welders or traction batteries for forklifts. That is now paying off.

Being able to deliver is crucial

Also critically important: Being able to deliver. Until mid 2017, the purchase price of lithium storage for installing companies will have slid to 300 to 500 euros per kilowatt hour. Anyone still setting a price of 700 euros for storage that will not even be delivered until a year from now is really taking their time. No one is willing to wait for things anymore in this market – least of all installing companies and their customers. Anyone not able to achieve economic efficiency by this year (2016!) will have a hard time later on.

It is most of all the independent storage companies who do not benefit from the protection of a financially strong corporation that are trying their best to conquer the German market and to develop new markets abroad. And another thing that has become clear at this year’s Intersolar: There is no longer such a thing as a period of grace. The storage market is picking up steam – here in Europe, in the US, in Japan and in Australia. It remains to be seen, which products and companies will merit the trust invested in them by the installing companies. (HS)

Read further insight reports:

Solarwatt is entering the UK market for energy self-consumption with partner network

8 expert tips for solar energy storage every home builder should know about