Total corporate funding (including VC, Debt, and Public Market Financing) in battery storage came to $244 million in nine deals compared to $635 million in 10 deals in Q4 2019. Funding was up 88% year-over-year (YoY) compared to $130 million in nine deals in Q1 2019.

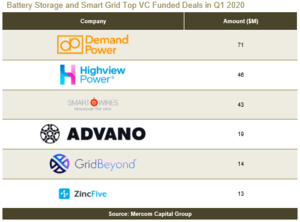

Venture capital (VC) funding (including private equity and corporate venture capital) raised by battery storage companies in Q1 2020 came to $164 million in six deals compared to $78 million in seven deals in Q1 2019. Quarter-over-quarter funding was also higher compared to $126 million in seven deals in Q4 2019.

The top VC funded battery storage companies this quarter were: Demand Power Group, which raised $71 million from Star America; Highview Power raised $46 million from Sumitomo Heavy Industries; Advano raised $19 million from Mitsui Kinzoku SBI Material Innovation Fund, Future Shape, PeopleFund, Thiel Capital, DCVC, Y Combinator; ZincFive raised $13 million from 40 North Ventures, and TWAICE raised $12 million from Creandum.

Fourteen investors participated in battery storage funding this quarter.

In Q1 2020, announced debt and public market financing for battery storage technologies was 54% higher YoY compared to $52 million in two deals in Q1 2019.

One battery storage project fund of $140 million was also announced in the quarter.

Four M&A transacitions involving battery storage companies

There were four M&A transactions involving battery storage companies in Q1 2020 (no transaction amounts disclosed). There were no M&A transactions in Q4 2019. There were four M&A transactions in Q1 2019, of which only one disclosed the transaction amount.

Blackstone Energy Partners acquired NRStor C&I, a subsidiary of NRStor, a developer of battery storage solutions.

There were four announced project M&A transactions in the battery storage category in Q1 2020 (all transaction amounts were undisclosed

Smart grid

Total corporate funding in smart grid came to $86 million in nine deals compared to $32 million in 16 deals in Q1 2019.

VC funding for smart grid companies increased in Q1 2020 with $81 million in seven deals compared to $32 million in 15 deals in Q1 2019.

The top 5 VC funded smart grid companies included: Smart Wires, which secured $43 million; GridBeyond raised $14 million from Energias De Portugal, Act Venture Capital, Electricity Supply Board, and Total Carbon Neutrality Ventures; Driivz raised $11 million from Gilbarco Veeder-Root and Centrica Innovations; Leap raised $8 million from Union Square Ventures, Silicon Valley Bank, Congruent Ventures, National Grid Partners, Powerhouse Ventures, Elemental Excelerator, and FJ Labs; and BluWave-ai raised $4 million from Sustainable Development Technology Canada and OCE.

Twenty-two investors participated in smart grid VC funding rounds this quarter with Grid Optimization company raising the most.

Five million dollars was raised in two debt financing deals in Q1 2020, compared to $28 million in one deal in Q4 2019. In a YoY comparison, $1 million was raised in one debt financing deal in Q1 2019.

Did you miss that? Scale-up of solar and wind puts existing coal, gas at risk

Five M&A transactions were announced in Q1 2020 (none disclosed transaction amounts), compared to six undisclosed transactions in Q4 2019. In a YoY comparison, there were 10 M&A transactions (one disclosed) in Q1 2019.

EDF acquired a majority stake in Pod Point, an electric vehicle charge point provider.

Energy efficiency

Total corporate funding in energy efficiency came to $7 million in three deals compared to $345 million in two deals in Q4 2019. In a YoY comparison, $155 million was raised in two deals in Q1 2019.

VC funding raised by energy efficiency companies in Q1 2020 came to $7 million in three deals compared to $30 million in one deal in Q4 2019. In a YoY comparison, $100 million was raised in one deal in Q1 2019.

Eight investors participated in VC funding this quarter.

In Q1 2020, there were no debt and public market financing deals according to the report. By comparison, in Q4 2019, $315 million was raised in one deal. In Q1 2019, there was also one deal for $55 million.

In Q1 2020, there was one M&A transaction for $1.4 billion, while in Q4 2019, there was no M&A transaction. In Q1 2019, there was one M&A transaction for $310 million in the Energy Efficiency sector. (HCN)