Read Part One: “In the Battery Sector There Are Very Few Local Markets Left”

Read Part Two: “A Battery Cell Has 150 Dials That You Can Change While You Are Making It”

What do you expect about the commercial units?

Herbert Schein: Just recently, in Haag near Munich, we installed a large-scale storage system with a capacity of 200 kilowatt hours and 250 kilowatts of power. It stabilises the electricity grid of a village that during the summer months feeds a massive power surplus into the low-voltage grid. Storage is a less costly alternative to upgrading the distribution grid, which would have been a much greater undertaking. A grid upgrade allows moving power around in space. One thing only storage can do: move it in time as well, for instance from noon into the evening or the night.

How is the market for large-scale storage developing?

Medium-sized storage systems of 50 to 200 kilowatt hours have the best prospects. We have thoroughly tested these solutions and can deploy them at short notice – much faster than chemical processes such as power-to-gas. Further, acceptance for electricity storage is still very good among the general population. Battery units are seen as safe and clean. People have fewer misgivings against them than against power lines or chemical factories producing hydrogen or methane.

Who buys the most stationary storage units?

So far, the Germans. In Austria a market is also emerging. We are currently preparing to launch in the US, where there is more demand for larger units for various corporate applications. Because of high peak load prices, ‘peak shaving’ is very profitable. Our second track is backup storage for the residential market. In many places, the grid is sometimes switched off for hours at a stretch. Or in case of severe weather: Power plants are taken offline and the electricity supply breaks down. Australia is also an emerging market with good prospects. And we are beginning to sell units in Italy.

Which applications dominate in Europe?

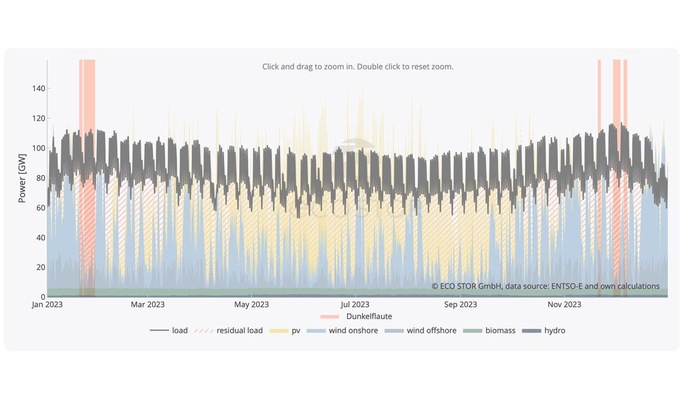

Clearly, there is an increase in self-consumption, primarily from solar. However, we are noticing that storage seems to gradually become decoupled from PV. You can also deploy it in combination with cogeneration units. It is our goal, whenever possible, to stop feeding electricity into the grid entirely.

For any further development of the market, it is critical that the prices of lithium ion cells come down. What future trends are you seeing?

We have already pre-empted that development where prices are concerned. An end consumer can now buy a storage system for 1,000 euros per kilowatt hour. And that is the price for the entire system rather than just the cells or battery modules. Of course, I am very optimistic that rising quantities will probably bring about falling prices as well. To save on costs, it is also possible to build more simple storage units which are attractive as far as the price is concerned, but lack the functionality of fully-equipped units. Under no circumstances should price come at the expense of quality and durability. Varta Family and Home are guaranteed for 14,000 charge cycles – that is quite a lot. For a realistic picture, it is fair to calculate these costs over the unit’s lifespan.

What new products are on the horizon?

We not only deal with domestic storage systems, but also with units for small businesses and agriculture. Here, we are going to introduce a platform starting at 24 kilowatt hours which can easily be converted into a large-scale unit.

The interview was conducted by Heiko Schwarzburger, editor-in-chief of pv Europe.