A first tranche of EUR 12 million will be used to refinance a portfolio of 50 solar plants with 48 MW. The capital will flow via a subordinated loan to the group company Sunfarming Polska IPP GmbH & Co. KG ("Sun IPP"), which bundles Sunfarming's currently operating projects in Poland under one roof and was established specifically for the partnership. Capcora acted as exclusive financial advisor to Sunfarming in the transaction. The financial close took place at the end of December 2022.

The mezzanine financing was issued in euros and has a term of 20 years. As the projects are remunerated in Polish zloty, an adequate currency hedge was the focus of the structuring. Together with specialists, a robust solution was devised that enabled asset manager Hansainvestt Real Assets to finance the transaction with a low risk premium despite the currency mismatch in the cash flow profile.

Contract for difference system provides inflation protection

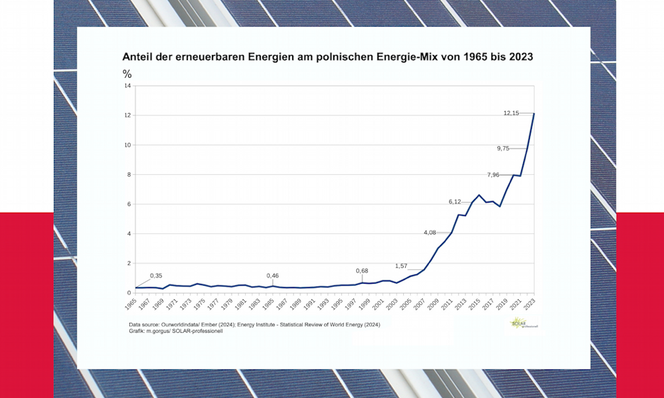

Sunfarming, the owner-managed company based in Erkner near Berlin, will use the financial resources to develop further solar parks. In addition to its home market of Germany, Poland is the largest market for Sunfarming. The company is also one of the pioneers in the Polish market, which set a new addition record of around five gigawatts in 2022 and was the largest photovoltaic market in Europe behind Germany and Spain.

Did you miss that? New PV projects in Poland and Romania with 183 MW

"We are pleased to be making our debut in the Polish renewable energy market with an existing partner who has also been active in the Polish market for years and already has a significant track record. We are convinced that Poland offers tremendous growth opportunities for us. The contract for difference system also provides inflation protection on the electricity revenues, which gives our investment further security," said Christoph Lüken, Head of Portfolio Management Infrastructure at Hansainvest Real Assets.

Complex transaction

"We are expanding our successful partnership with Hansainvest Real Assets. Poland is our second main market and we are grateful for the trust in our work, which is underlined by the extension of the partnership. 2022 has shown the potential that lies dormant in the Polish market and we are happy to take our partners with us on this journey," said Martin Tauschke, managing director of Sunfarming Group and Sun IPP.

Also interesting: Bond financing of new solar parks in Hungary

"The transaction represents one of a small number of mezzanine financings in the still young but growing solar market. Euro financings present challenges to the industry due to a lack of cross currency swap liquidity in the long term. We are pleased to have been able to contribute to this complex transaction, having already assisted Sunfarming in structuring the interim construction financing and bank refinancing," explains Bernhard Hofmann, Director in Capcora's Energy and Infrastructure division.

Hansainvest Real Assets was supported in this transaction by Dentons, Baker Tilly and Renerco Plan Consult. On the side of Sunfarming Group, Bird&Bird and Rödl&Partner acted as legal advisors and Capcora as exclusively mandated financial advisor. (hcn)