What were the reasons for Goldbeck Solar to establish a subsidiary in Poland?

Goldbeck Solar had already implemented photovoltaic projects in Poland over the years. In 2021 and 2022, the decision was made to set up an independent company for the country. The Polish subsidiary is based in Poznan and has 40 employees. We provide all services related to the value chain of photovoltaic projects, from planning, obtaining all permits, to grid connection, after-sales service, maintenance and accounting. The focus of the Polish team is on construction and EPC business.

Subscribe now to our monthly special newsletter for investors!

What size do the projects in Poland have?

We develop open-space systems with 10 to 204 MW. This year, our Polish branch implemented a megawatt roof project for the first time. We expect to implement more large roof systems in Poland in the future.

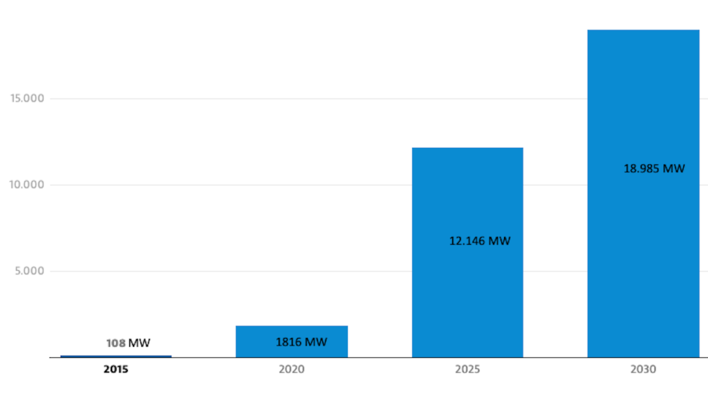

Central and Eastern Europe increasingly in the solar gigawatt class

What are the challenges of the Polish photovoltaic market?

The processes for approving and implementing photovoltaic projects are very bureaucratic in Poland. Our Polish colleagues face two specific challenges with every project. First, the power grid limits the connection capacities. In addition, there are bureaucratic and complicated approval processes for photovoltaic systems in the megawatt range. Second, systems on the roofs require not only structural proof, but also a building permit in every case.

Strategic partnership of Menlo Electric and Sungrow

Who is investing in large photovoltaic systems in Poland?

Our customers in Poland are private investors and energy suppliers for open-space systems. For rooftop systems, it is mainly companies that want to generate their own electricity and owners of large buildings who resell the solar energy. Electricity is sold primarily via Power Purchase Agreements (PPA). In Poland too, electricity prices have risen sharply in recent years that a kilowatt hour of photovoltaic electricity is usually more than five euro cents cheaper than a kilowatt hour of electricity from the grid.

Polish Development Bank signs financing agreement with R.Power

How do the German Goldbeck Solar and the company in Poland work together?

Our branch in Poznan is an independent part of the Goldbeck Group. The German parent provides security and supports with group and bank guarantees. All contracts concluded in Poland are 100 percent handled by the Polish company. Our commitment to the Polish market was a strategic market entry with the aim of building up the team and the branch sustainably, with good jobs and long-term prospects for the employees. Our original goal was to achieve at least 150 MW per year. Currently, we are already at 200 megawatts per year.

EBRD funds EV charging infrastructure in Eastern Europe and Baltics

What role does politics play in the Polish photovoltaic market?

Our team describes the Polish market as very bureaucratic and with many political dependencies. With every change of government, contacts and conditions change, not only at national but also at regional level. These are business challenges that our colleagues in our branch have to deal with.

More news and insigts about the Polish market

Does this influence the demand from the market?

There is already a great demand for solar parks in Poland and a growing market for large rooftop systems. Due to the still large share of coal-fired power generation in the Polish energy mix and the rising electricity prices, we see a growing market with good future prospects. In addition, Poland, like all EU countries, is under pressure from emission saving measures. In Poland, as in practically the whole world, photovoltaic power is now much cheaper than electricity from coal. We see another interesting and growing market segment in grid-friendly battery storage systems. There is increasing demand, too.

Interview conducted by Manfred Gorgus.