Norges Bank Investment Management is paying 203 million euros for the 49 percent stake. The portfolio has a total value of 414 million euros. No external financing is required for the transaction.

Iberdrola remains part owner and operator of the portfolio. This is an expansion of the portfolio that the Norwegian sovereign wealth fund purchased from Iberdrola in January, which consists of two solar power plants and two onshore wind power plants in Spain and Portugal.

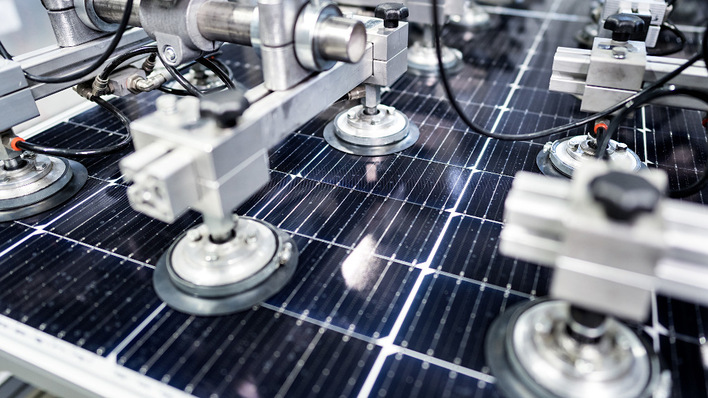

The new portfolio consists of two solar power plants with a total installed capacity of 644 MW, which corresponds to the annual electricity consumption of around 400,000 Spanish households.

Strong alliance with Iberdrola for futher renewable projects

One of the projects is operational and the other project is under development and is expected to be completed in 2025. Norges Bank Investment Management plans to take over this project as soon as it is operational. As one of Iberdrola's main shareholders, Norges Bank Investment Management has held a three percent stake for more than seven years.

Also interesting: Major utilies intent to raise renewable capacity by 2.5 times to 2030

This long-term relationship helped Norges Bank Investment Management in its decision to make its first direct investment in renewable assets in Spain with Iberdrola, Europe's largest electricity company by capitalization, the company said. The strong alliance between two preferred partners could be expanded in the future to include additional renewable energy opportunities in other countries. (hcn)